Bank of America (BA) has acquired Merrill Lynch, but billions of dollars are still needed to complete the process and to help mend related exchange traded funds (ETFs).

Financials in Trouble. Shareholders may need to brace themselves, because Bank of America slashed its dividend to a penny in an effort to shave off costs and receive help from the Treasury Department. The financial systems remain in a state of distress, and the Treasury Department handed out $350 billion to financial institutions in need through the TARP program, without much question. Bank of America received $25 billion of that money.

What’s Fair? Matthew Goldstein for BusinessWeek reports that going forward, isn’t it only fair to demand that all of the nation’s bankers take whatever steps they can to cut costs and preserve capital before getting any more government help? The government is already pondering if they should nationalize Citigoup, and healthy banks such as Wells Fargo are trimming their dividends – this should be standard practice.

Doing All They Can? Dividends to ordinary stockholders has been cut, but preferred shareholders are still receiving dividends as they take priority over ordinary. The disturbance is that the bank asked for assistance before trimming any other dividend payouts. Analysts don’t expect other major banks to slash their dividends yet, but they’re paying close attention to earnings numbers.

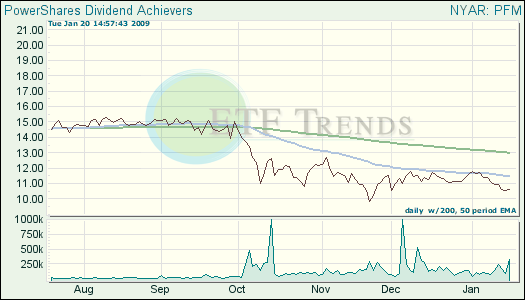

- PowerShares Dividend Achievers (PFM): down 9% year-to-date; BofA Inc. 2.4%

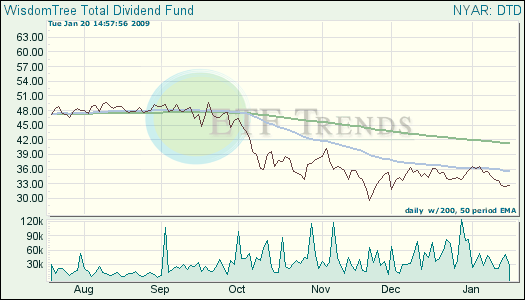

- WisdomTree Total Dividend (DTD): down 9.2% year-to-date; BofA Inc. 2.7%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.