Bubbles are a fact of life within stock markets and exchanges, so is there a way to analyze what is happening within stocks and exchange traded funds (ETFs) to recognize one?

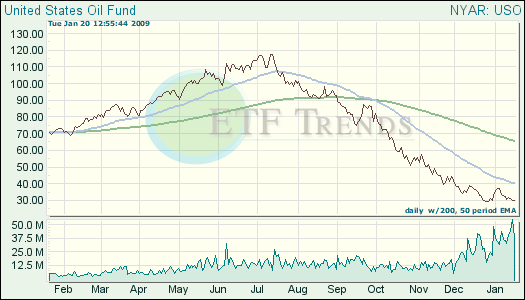

Anyone who watched the runup in the price of oil and the oil exchange traded fund (ETF) last summer might know what a bubble looks like in hindsight. Note the rapid surge, followed by a steep dropoff:

The fact remains that investors make a lot of money during market bubbles. However, it is easy to get caught inside of a bubble and then miss warning signs that are telling you to get out. This is why we have an 8% stop loss – once a fund declines 8% off the recent high or dips below its 200-day moving average, we get out. This protects us from further losses.

By not getting out in time and hanging on in the hopes that the trend will reappear, all of the gains that are made are given back in the end. Andrew Mickey for Seeking Alpha reports to us on how a bubble can be spotted and when it is time to be careful because it will pop.

- Analysis of a bubble: As a base begins to form, shares in the sector start to move up a bit compared to the rest of the market and then there’s some institutional buying. This all happens before the general public is aware, and then once the idea is tangible, the bull market begins within that sector. The run-up continues and the party goes on, until some forget they are even in the shares. Then the plunge starts and the bubble is about to burst.

- Is the life of a bubble ever different? Not really. It usually takes three years to earn those through-the-roof gains, and then in six months they can vanish.

- Use your weight: Ups and downs can be painful if they’re ridden out, as buy-and-hold investors have learned in the last year. Instead, by paying close attention to trends, you can get in when an area is moving and hit the exit button before it’s too late.

- Relativity: Sector weight analysis are not a perfect timing strategy, and it is not for short-term investors. Long-term opportunities are the goal when determining a bubble. Also, a good strategy is worth its weight if you stick to it. For more information on our strategy, read our trend-following report.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.