The economy continues to be in a funk, but at least consumers are feeling a little more chipper on lower prices. But will it have the needed effect and bring those exchange traded funds (ETFs) back above their trend lines?

Prices Plummet. Inflation in 2008 was the slowest it’s been since 1954, mere months after it had hit 17-year highs, reports Brian Blackstone for The Wall Street Journal. Blame the 75% decline in oil prices since they hit their July peak.

That’s not all, though: the recession we’re in has also caused nervous consumers to stop spending in general, which could lead to a drastic deflationary spiral if it persists.

The Bureau of Labor Statistics says that the Consumer Price Index declined 0.7% in December for the third straight month, reports Jack Healy for The New York Times. It’s a slight drop from November, when the CPI declined 1.7%.

Financial Industry Woes. Both Citibank (C) and Bank of America (BAC) are working on straightening out their balance sheets. Citi is splitting its operations in two, separating its banking division from the company’s riskier assets, reports Stephen Bernard for the Associated Press.

Bank of America reported today that it lost $2.4 billion. The report came just hours after a deal that the bank would receive another $20 billion in government support.

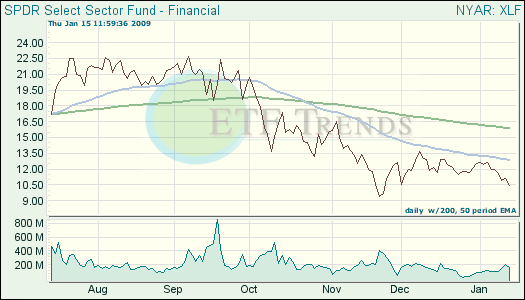

- Financial Select Sector SPDR (XLF): down 34.5% over past three months; Bank of America is 7.8%; Citigroup is 4.3%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.