Intel Corp., the world’s largest chipmaker, has lowered their fourth quarter outlook and dampened hopes within the technology sector and related exchange traded funds (ETFs).

The corporation said Wednesday that it would miss its revenue projection by about $500 million, a sign that PC makers and buyers are being more tightfisted than it seemed only two months ago, reports the Associated Press. The Santa Clara, CA-based company reports revenue is down 23% form one year ago.

This is the second revision that the company has made for their fourth-quarter earnings, indicating how deeply and sharply the economic slowdown has dug into the semiconductor industry.

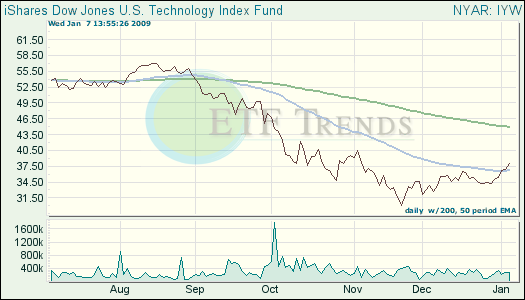

- iShares Dow Jones US Technology (IYW): down 10.4% for three months; Microsoft 12.5%; IBM 9.1%; Intel is 6.4%. IYW is 3.6% above 50-day, but will it stick in light of the recent news?

Other negative indicators within the technology industry include:

- Microsoft is rumored to be downscaling its workforce soon, reports Tom Magrino at GameSpot.

- Microsoft is also rumoed to be downsizing contract employees, and eliminate positions, as well.

- Internet browser business from Microsoft down 68% in December.

- IBM, the largest technology employer, might cut thousands of jobs this month, reports Katie Hoffman for Bloomberg.

- IBM may post a 1.6% drop in sales in the fourth quarter, according analysts.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.