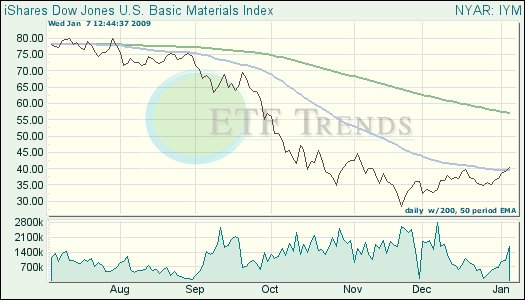

Job losses mounted in December and basic materials suppliers have added to the bleak unemployment picture created in the United States, giving far off hope for markets and exchange traded funds(ETFs).

Businesses from Alcoa (AA) to Intel Corp. (INTC) have suffered losses up to 11%, and have experienced a worsening profit outlook for the time being. Alcoa, the world’s largest aluminum producer, is set to cut their workforce by 13,500 while Intel Corp., the world’s largest chipmaker, has reported a fourth quarter sales drop of 23%, reports Lynn Thomasson for Bloomberg.

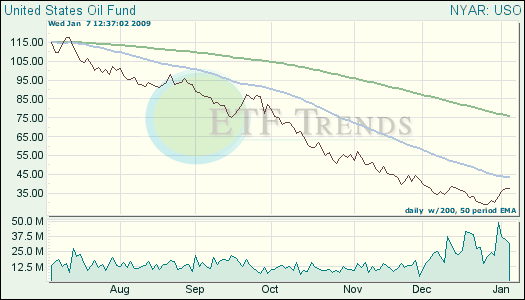

Energy has taken a lesson in volatility, as U.S. oil reserves have been reported higher than expected, indicating demand will keep falling. Across the board, energy prices have tumbled, and sweet crude for February delivery plummeted to $44.54 a barrel on the New York Mercantile Exchange, reports Dirk Lammers for Associated Press.

- United States Oil (USO): down 48% over past three months, but up 24.2% in the last two weeks

Alcoa has announced plans to cut their output by 18% this year, with plant closings and workforce reduction a part of the plan. They plan to cut their work force by 13%, or 13,500 employees, while eliminating 1,700 contractor positions, reports Julie Creswell for The New York Times.

Similar to other materials producers, Alcoa has tried to cope with the dropoff in demand for manufactured goods. Aluminum consumption in crucial areas such as automotive and consumer sectors has dropped sharply.

- iShares Dow Jones US Basic Materials (IYM): down 16.1% over past three months; Alcoa is 3.8%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.