The Treasury Department is the latest owner of preferred shares and warrants in around 208 different U.S. financial institutions, but why aren’t consumers and exchange traded fund (ETF) investors reaping the rewards yet?

Despite having injected billions into them, the Treasury Department has been so far unable to make banks lend, leaving most U.S. citizens with a frozen credit market that is being held up with taxpayer money. James Sterngold for Bloomberg says that while most of the inter-bank lending rates have dropped, lending remains tough to come by and rates are still unfavorably high.

Many are pondering whether banks should have their access to taxpayer money taken away if they do not increase their lending risk. It is up to the government to force this regulation because the public’s well-being is the only road to private good.

There’s also a question of how much demand is currently in the market for loans – consumers just aren’t buying or asking for loans for anything. In some ways, this is a good thing, because we should have been saving and limiting our exposure to debt. But in other ways, consumer spending is two-thirds of the economy, and until that comes back, we may remain stuck.

TARP has since allocated $250 billion toward non- voting preferred shares of banks paying a 5% annual dividend, as well as warrants convertible into equity. The investments range from $25 billion each in J.P. Morgan Chase & Co. (JPM), Citigroup Inc. (C), Saigon National Bank, and American International Group Inc. (AIG).

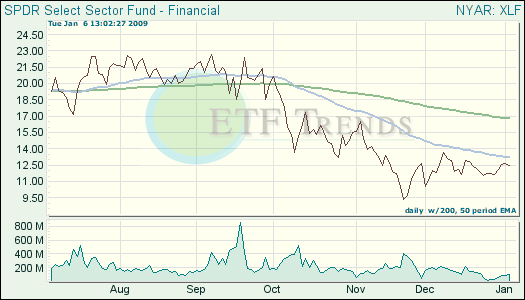

- Financial Select Sector SPDR (XLF): down 1.4% for the last month; JP Morgan 11.12%; Citigroup 4.30%

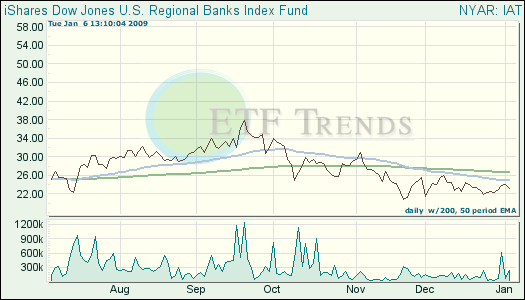

- iShares Dow Jones U.S. Regional Banks Index Fund (IAT): down 8% for the last month

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.