Obama’s plan is unveiling itself slowly and the latest news on tax cuts have many optimistic and hoping that the anticipated tax cuts could boost spending and help related exchange traded funds(ETFs). American citizens and a number of sectors are salivating at the opportunities such a sweeping plan could bring.

Around $300 billion in tax cuts to workers and businesses in the economic recovery program would come from government spending, accounting for around 40% of the cost related to tax cuts, reports Pater Baker and Carl Hulse for The New York Times. The package will also include more than $100 billion in tax incentives for businesses to create jobs and invest in equipment or factories. There is also a credit of $500 for workers, totaling $150 billion. Along with the infrastructure spending and money used for basic materials, this rounds off the package total of $675-$775 billion for the economic stimulus.

In response to this news the dollar rallied against the euro to three week highs, and also gained against the Swiss franc and Danish krone, reports Ye Xie and Anchalee Worrachate for Bloomberg. The dollars’ gains have been seen as superficial and the U.S. currency is expected to fall again, according to analysts.

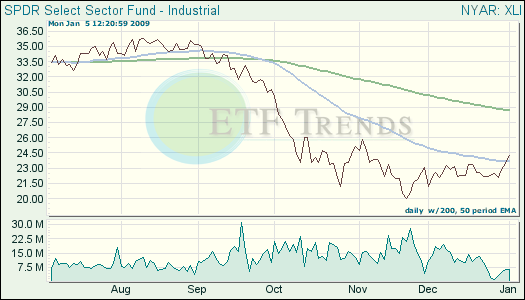

- Industrials Select Sector SPDR (XLI): down 38.7% in 2008

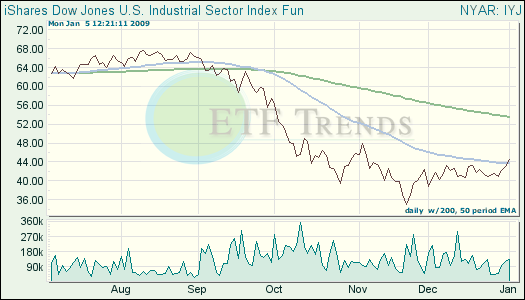

- iShares Dow Jones U.S. Industrial (IYJ): up 3.6% year-to-date

Investor optimism about the plan seems evident. Currency traders are sending the dollar up sharply today on the belief the Obama’s plan will help the U.S. economy rise out of the recession, says Joseph Lazzaro for Blogging Stocks. One currency trader says the trading desks are sending signals that they expect the worst of the recession to be over by mid-year.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.