The holiday shopping season is drawing to a close, and the retailers and related exchange traded funds (ETFs) didn’t get the turnout they had hoped for.

Despite the deep discounts and early clearance sales, retailers were unable to lure consumers and spur a spending rally as they has anticipated. Many knew it would be a weaker then usual holiday season, however, the hopes of a rebound or breaking even is now out of the question for some businesses.

Andrea Chang and Mark Medina for The LA Times report that around 73,000 stores are expected to close their doors at the New Year and smaller shopping centers will be at risk as a result. In the meantime, retailers are doing what they can to stay afloat; some are reducing inventory, others are delaying store openings and hiring fewer workers. Major chain stores are releasing December sales data next week. Some big names are simply merging with large players such as Mervyn’s and Linen’s N Things.

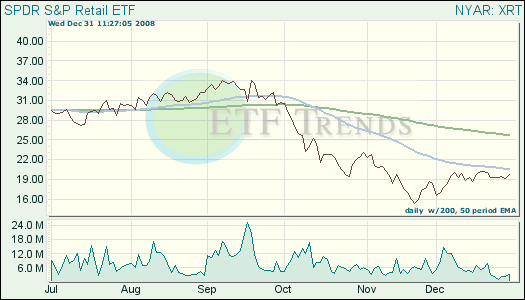

- SPDR S&P Retail (XRT): down 42.6% year-to-date

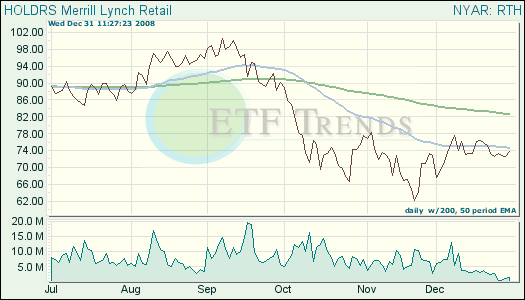

- Retail HOLDRs (RTH): down 22% year-to-date

Among major national retailers, ones closing their doors or downsizing substantially include:

- Linen’s N Things: closing all stores

- Disney Stores: closing 100 stores in the United States and Canada

- Foot Locker: closing 140 stores, after closing 274 last year

- Wilson’s Leather: closed the majority of its mall-based stores

- Ann Taylor: closing 117 stores by 2010

- Zales Jewelers: closing 105 stores

- Sharper Image: closed all stores

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.