China has a stimulus plan of its own, and their shopping spree is based upon raw materials and energy, in an attempt to salvage investments and exchange traded funds (ETFs).

Announced in early November, the stimulus package was targeted to maintain growth at 8% for the year 2009. This follows the $585 million stimulus previously implemented. Illywacker on My Stock Voice says that the world’s second-largest oil consumer will take opportunity of the financial crisis and take the time to expand energy cooperation with neighbors and major oil producers.

China would actively push forward the construction of the second phase of state strategic oil reserves after having largely completed the first phase. China has completed the planning of the second phase of government storage facilities that would be able to hold up to 26.8 million cubic meters of oil, or some 170 million barrels.

Chinese officials are also buying up resources and materials to support producers. The State Reserve Bureau (SRB), have announced that will buy 300,000 tons of aluminum at about $1,750 per ton in January 2009 to push up prices.

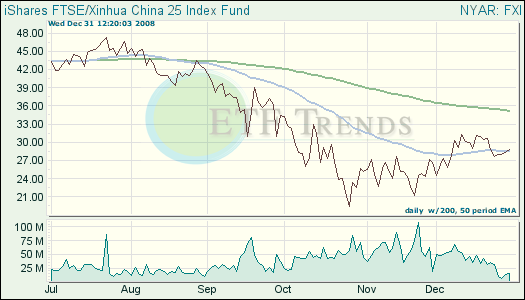

- iShares FTSE/Xinhua China 25 Index (FXI): down 49.7% year-to-date

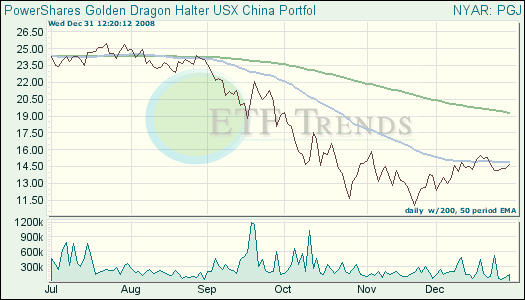

- PowerShares Golden Dragon Halter USX China (PGJ): down 57.8% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.