After a rocky start, the euro and exchange traded funds (ETFs) that track its movements now have reason to celebrate. The currency turns 10 years old in a few days, and has many economists feeling reflective.

Nearly a decade ago – Jan. 1, 1999 – Europe launched their shared currency, only to watch it fall, and then recover to solid ground. Economists are giving the euro a nod, as it has fulfilled the promise to lower borrowing costs, ease trade and tourism, boost growth and strengthen the European community in general, reports Matt Moore and George Frey for the Associated Press.

The euro has helped Europe to stave off inflationary pressures, created the zone of stability and security for those nations joined, and given strength to the overseas currency against the U.S. dollar. At one time, it was as high as $1.6038 US.

Many countries that decided to stay out of the European Union, such as Iceland and the United Kingdom, are asking for financial bailouts at this point in time. The sterling hit an all-time low against the euro as the United Kingdom is facing more rate cuts before stabilizing.

Meanwhile, the British pound has hit a record low against the euro today, on news that more interest rate cuts in the United Kingdom could be coming, reports Naomi Tajitsu for Reuters.

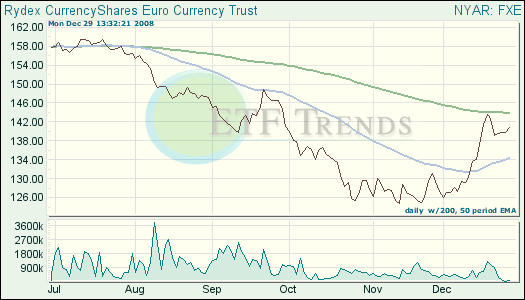

- CurrencyShares Euro Trust (FXE): down 0.5% year-to-date

- CurrencyShares British Pound Sterling Trust (FXB): down 23.4% year-to-date

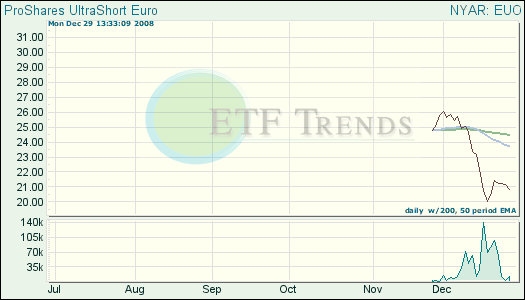

- UltraShort Euro ProShares (EUO): down 16% since inception

Read the disclaimer, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.