The sales of existing homes and new homes felt the chill of November, as the month posted a faster-than-expected drop in home sales, taking down related stocks and exchange traded funds (ETFs).

The latest dropoff in sales has also caused the average price of a home to decline, taking their steepest dive in more than four decades, reports Jack Healy for The New York Times. Existing home sales fell 8.6% last month to 4.49 million, while the median price for a home fell 13% from October to November, to $181,300 from $208,000 one year ago.

Alister Bull for Reuters adds that home sales are at their lowest levels since 1991, taking the state of the housing market to new levels of distress. Average or median marks the half-way point, with half of all houses sold above that level and half below.

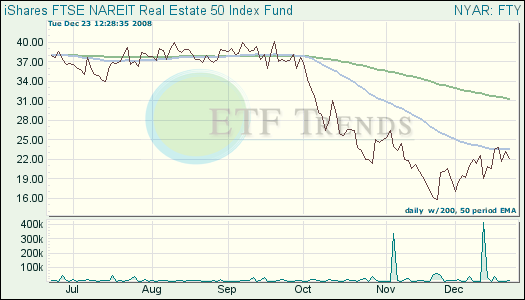

- iShares FTSE NAREIT Real Estate 50 (FTY): down 41.6% year-to-date

Undermining the housing slowdown is the overall weakness in the U.S. economy, as December was the first month since an “official” recession was declared, even though it’s been going on for a full year now.

The third quarter posted an expected 0.5% annual pace for contraction, a result of businesses and consumers pulling back on their spending. Alister Bull for Reuters reports that the failure of Lehman Brothers investment bank in September was the start of the slowdown, and the pullback deepened after credit markets froze, slowing domestic and business spending.

Overall, the third quarter GDP pullback was the steepest yet. Analysts were expecting this, however, so financial markets barely reacted.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.