Eleven U.S. and European banks that can count themselves as top holdings in some exchange traded funds (ETFs) found themselves downgraded by Standard & Poor’s Ratings Services this morning.

S&P bases the downgrade on pressures facing the large financial institutions in the future, because of increasing risk and a worsening global recession, reports Kerry E. Grace for the Wall Street Journal. They note that government intervention in order to bring stability to the sector should balance out some of the pressure, though.

In ordinary times, S&P doesn’t consider government support to be a factor in its ratings process. But so many governments have stepped in that an exception has been made. None of the banks should have a rating lower than A+, because of the expectation of that support.

Banks downgraded are: Bank of America (BAC), Barclays, Citigroup (C), Credit Suisse Group (CS), Deutsche Bank (DB), J.P. Morgan Chase & Co. (JPM), Morgan Stanley (MS), Royal Bank of Scotland, UBS (UBS), Wells Fargo (WFC) and Goldman Sachs (GS).

HSBC’s (HSBA) outlook has been changed to negative, meaning a downgrade is possible.

Several of these banks can be found in financial ETFs, including:

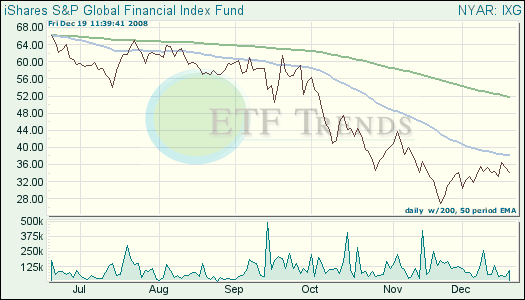

- iShares S&P Global Financial (IXG): down 56.2% year-to-date; Bank of America, 2.8%; Citigroup, 1.6%; HSBC, 4.6%; JP Morgan, 4%; Wells Fargo, 3.7%.

- Financial Select Sector SPDR (XLF): down 57.1% year-to-date; Bank of America, 9.6%; Citigroup, 5.9%; Goldman Sachs, 3.2%; JP Morgan, 12%; Wells Fargo, 8.9%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.