OPEC has cut production of a record 2.2 million barrels of oil from their daily volume, hoping to raise demand and support related shares and exchange traded funds (ETFs). But will it even work?

Saudi Arabia is cutting production as of Jan. 1, while Russia and Azerbaijan are cutting hundreds of thousands of barrels from production, reports George Jahn for Associated Press. This is the largest single production cut ever from OPEC nations and the only comparison was four years ago and the cut was done in stages.

- While OPEC’s cut is meant to drive oil back up to higher prices, other recent cuts haven’t done much to accomplish that goal. At two previous meetings, the countries agreed to cut output by 2 million barrels per day, but demand kept falling and stockpiles kept rising.

- In fact, this morning, oil prices are still falling despite the cuts.

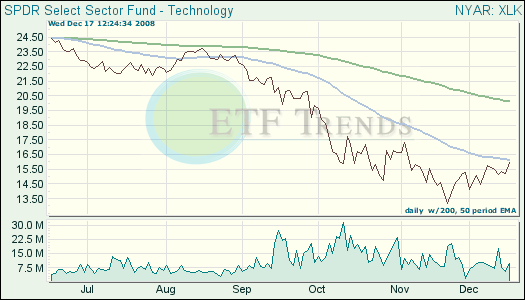

Within the tech realm, the chief executive of Apple Inc. (APPL) has declined to give his keynote speech at the upcoming tech show in San Francisco, breaking tradition and causing company shares to falter on concerns about his health.

This will be the last Macworld show and a product marketing executive is going to deliver the opening keynote speech instead, reports Reuters. Reasons for Steve Jobs to skip the Macworld show are rumored to be commercial, especially since the company is going to discontinue the show here on out.

- Technology Select Sector SPDR (XLK): down 39.7% year-to-date;Apple 5.54%

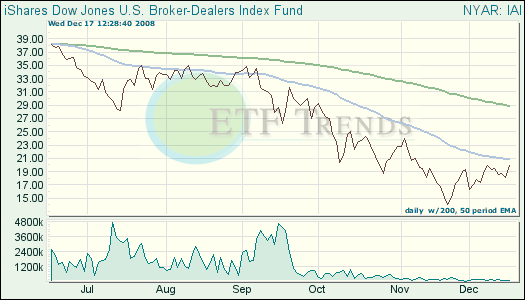

Morgan Stanley (MS) is struggling with the ghost of old investments, as the company reported fourth quarter losses at $2.36 billion, or $2.34 per share. Morgan reported a full-year profit of $1.59 billion, or $1.54 a share and this was the company’s first loss this year.

Louise Story for The New York Times reports that revenues in every area of the bank were down and this is a clue that the business environment is suffering on all levels. Losses within the company this year did not outweigh the profit earned earlier this year.

Goldman Sachs (GS) also posted a fourth-quarter loss of $2.1 billion, its first since going public in 1999. Goldman has long been the most profitable of the Wall Street’s largest firms, Bloomberg says.

- iShares Dow Jones U.S. Broker-Dealers (IAI): down 60.7% year-to-date; Morgan Stanley is 5.4%; Goldman Sachs is 8.1%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.