Rumors of a bailout deal between the White House and Democrats are spreading, and if the deal goes through, a crisis that could have further sent the economy and exchange traded funds (ETFs) into another downward spiral may have be averted. The deal is not official yet, however.

Emergency loans amounting to $14 billion will go to U.S. automakers in the deal. A vote will be taken in the House late Wednesday. Julie Hirschfeld Davis reports for Associated Press that the bailout is necessary to cut quick deals with labor unions, creditors, and others to revamp businesses and get up and running again.

So many industries are affected by the automakers, that if they were allowed to go bankrupt, it could have beaten up an already battered U.S. economy in a number of sectors, including retail, technology, industrials and industrial metals. Already lackluster ETFs would have seen even more poor performance, and jobless numbers would become even worse.

Wholesale is not experiencing a good season, as inventories have been slashed and more grim news lies ahead as the recession deepens. This is the largest pullback for wholesale since the September 2001 terrorist attacks. On the wholesale level, October saw a pullback of 4.1%, reports the Associated Press.

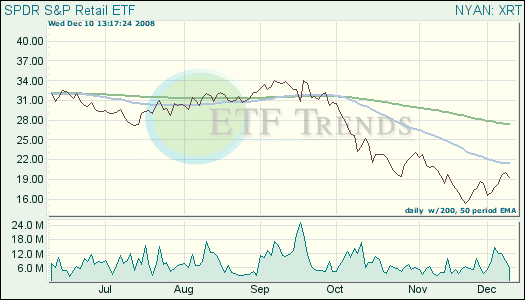

- SPDR S&P Retail (XRT): down 42% year-to-date

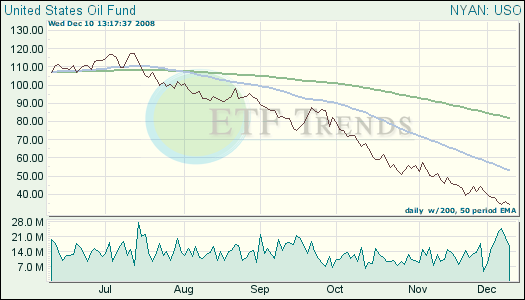

Oil prices are faltering as demand for crude is continues to slow, and the United States is leading the slowdown. Gasoline has even stocked up supply that can’t be exhausted, as motorists are choosing to stay home despite the sharp decline in prices. Although crude prices shot up Wednesday 5%, they soon dissipated after the reports came out, reports Mark Williams for the Associated Press.

- United States Oil Fund (USO): down 54.5% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.