Japanese manufacturers are slumping, and the sentiment could spread further into markets and exchange traded funds (ETFs) if there is no resolution.

The lowest sentiment in 34 years plagues Japan’s manufacturing sector, as the global slowdown has cause demand to disappear, reports Jason Clenfield for Bloomberg. A sentiment indicator that measures the confidence level in builders of cars and electronics is going to dive from -3 to -23, economists predict. Bank of Japan’s Tankan index will reveal the numbers on Dec. 15, however, the overall meaning lies in the idea that thee are more pessimists among few optimists.

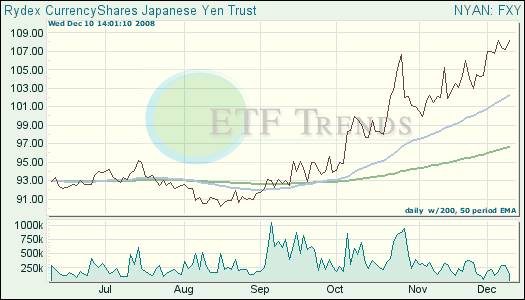

The strengthening yen has impacted Japan’s exports, because it makes their stuff more pricey. This could be contributing to their pain, as domestic spending will be slower than usual. Manufacturers are planning the biggest job cuts in 35 years. Japan is simply too entangled in the global markets to not be affected by the downturn.

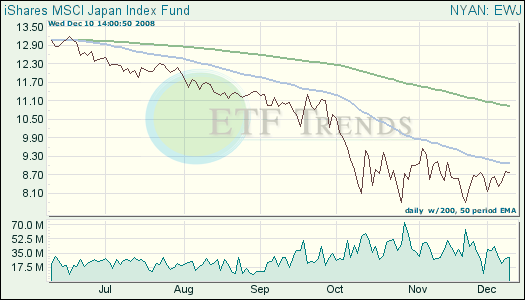

- iShares MSCI Japan Index (EWJ): down 33.8% year-to-date

- CurrencyShares Japanese Yen Trust (FXY): up 20.7% year-to-date

Read the disclosure, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.