A sliver of a ray of hope may be shining through the blur of the housing market, but not enough to reverse the trend seen in related shares and exchange traded funds (ETFs) for the moment. We’re not out of the woods yet.

The National Association of Realtors reported an dip in pending U.S. home salesin October from 89.5 in September, to 88.9 contracts in October, reports Lucia Mutikani for Associated Press. This beat economists’ predictions of 86.5, and the reading is 1% lower than one year earlier. Numbers like these show that while progress might be getting made, we are still hurting and we can’t begin to feel bullish again until these reports get solidly better.

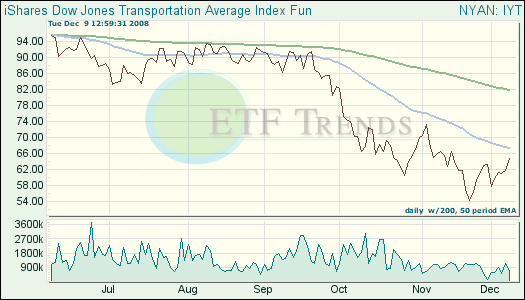

Meanwhile, corporate earnings are sparse and layoffs are spiraling out of control. As of Tuesday, shares on Wall Street are suffering, reversing a two-day winning streak, reports Michael M. Grynbaum for The New York Times. The Dow Jones Industrial Average fell 25 points as bad news from Texas Instruments (TXN) and FedEx Corporation (FDX) lowered their revenue projections.

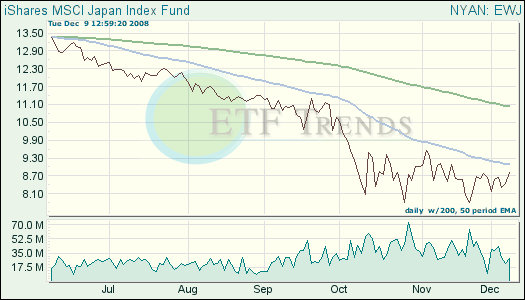

Sony (SNE) is also cutting 4% of its workforce, or 8,000 jobs. This is the largest cutback by the Japanese corporation since the credit crunch first touched down on the global economy. Sony will curb investments, outsource production and move away from unprofitable businesses by March 2010 to save more than $1.1 billion a year, reports Lena Lee for Bloomberg.

- iShares MSCI Japan Index (EWJ): down 33.3% year-to-date; Sony is 1.3%

- iShares Dow Jones US Transportation (IYT): down 19.9% year-to-date; FedEx 10.8%

The markets seem to be holding their breath for the announcement on the Big Three bailout. Both Congress and White House leaders say they are close to culminating the $15 billion government rescue plan, which would impose Federal regulation of the auto companies. Ford Motor Company claimed they do not need the government aid and were nowhere close to experiencing the liquidity issues that Chysler has been, reports David M. Herszenhorn for The New York Times.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.