Treasury secretary Henry Paulson met with Chinese officials to discuss the economies this week, but as major issues went unresolved, the impact on the country’s exchange traded funds (ETFs) in a positive way could be minimal.

The talks gave way to a stream of achievements including pledges by both nations to spend $20 billion to help developing countries finance trade. The jointly shares “fact sheet ” included topics such forest management, food safety, plug-in hybrid cars and offshore wind farms, reports Andrew Jacobs for The New York Times.

Investors today seem to be disappointed, as the sentiment that no true market-friendly news emerged from the meeting took hold, reports Claire Zhang for Thomson Financial. While pledges were made and a fact sheet drafted, large issues went unresolved. Instead, it highlighted tensions between the world’s largest economy and the world’s largest developing one.

Those issues include efforts to open China’s financial sector to U.S. securities firms, as well as tensions over government control of the yuan. Its weakness against the dollar has contributed to a trade gap between the two countries.

The meeting was the so-called Fifth Strategic Economic Dialogue, reports Export Industry News and touched upon other mutual topics such as:

- Macroeconomic cooperation and financial services

- Cooperation on energy and environment

- Trade and Investment

- Food and product safety

- International economic cooperation

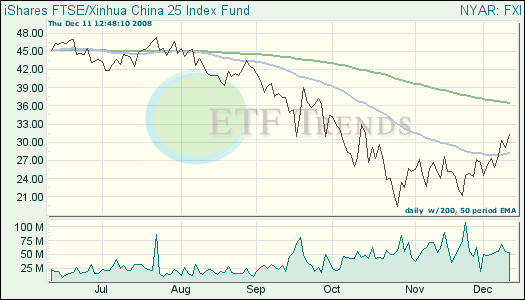

- iShares FTSE/Xinhua China 25 Index (FXI): down 44.3% year-to-date

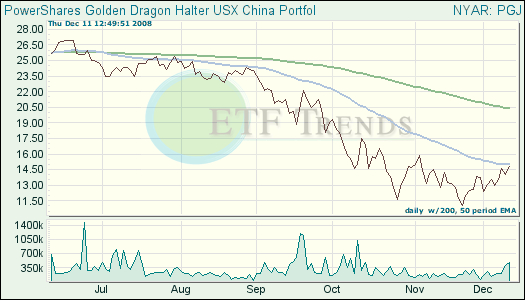

- PowerShares Golden Dragon USX Halter (PGJ): down 56.3% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.