After yesterday’s discouraging one for the markets and exchange traded funds (ETFs), things are suddenly looking up again.

The Dow Jones Industrial Average is trading higher as U.S. automakers turn in their plans for Congress. The lawmakers will debate now whether the industry should get a $25 billion bailout, report Kevin Krolicki and John Crawley for Reuters.

But one company is backing out of its request for bailout money. Ford Motor Co.’s (F) financial health is not as weak as anticipated, and their CEO reported that the car company has enough cash to make it through 2009, explains Sara Lepro for the Associated Press. Although this news pacified investors from the dip on Monday, Chrysler and GM (GM) are still submitting plans to Congress on why they need a $25 billion government injection.

Oil is down below $49 per barrel as of Tuesday, after falling to a three and a half year low of $48 dollars, reports Christopher Johnson for Reuters. Gas prices continue to fall, now in their 77th straight day of declines. The national average is now $1.82, reports Sign on San Diego.

Goldman Sachs (GS) has come up with a list of technology-focused companies that are worth their weight from a survival perspective rather than a growth one. Companies such as Google (GOOG), Microsoft (MSFT), and Cisco (CSCO) are missing from the list, as they fall outside the “circle of trust” of companies that are thought to have enough cash on hand, reports Paul Kedrosky in an interview on the Tech Ticker.

The small- to mid-cap companies are what Goldman are focusing on and they are key to a short-term defensive strategy, as the tech world has not had a major credit upset-yet. Companies that made the circle include Zoran (ZRAN), Verigy (VRGY), and Broadcom Corp. (BRCM).

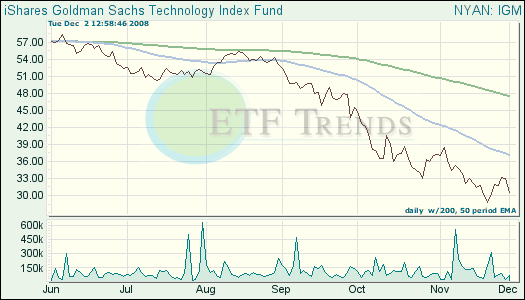

- iShares S&P North American Technology (IGM): down 48.6% year-to-date; MFST 10.3%; Cisco 6.8%; Google 5.4%

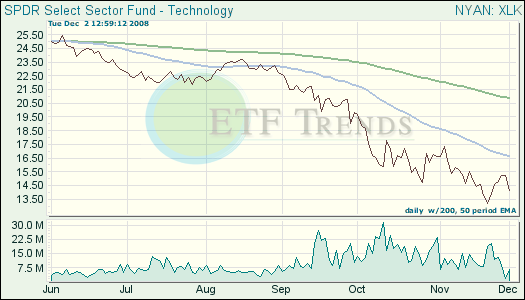

- Technology Select Sector SPDR (XLK): down 46.6% year-to-date ;MSFT 10.9%; Cisco 6.5%; Google 4.7%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.