Some have laughed off the ominous “head and shoulders” formation in the S&P 500. If everyone is talking about this pattern, then it can’t be a market top. Right?

However, a close beneath 1,233 on the index would active the head and shoulders top, said Tarquin Coe, technical analyst at Investors Intelligence, on Thursday.

The S&P was trading well below 1,220 at last check. [Head and Shoulders Pattern Developing?]

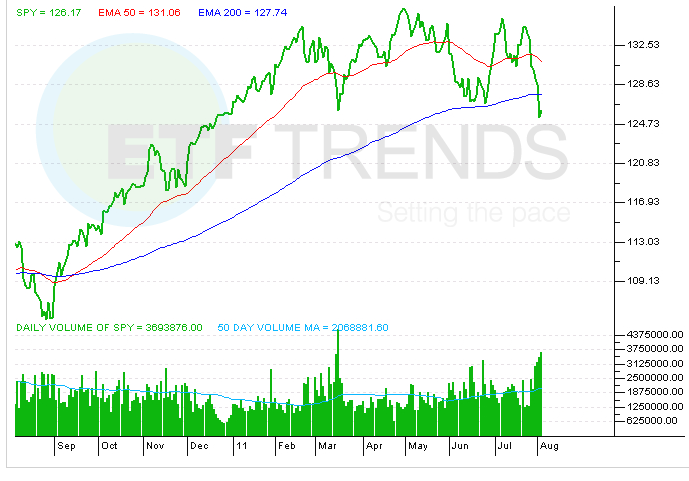

An exchange traded fund, SPDR S&P 500 ETF (NYSEArca: SPY), plunged 3.6% in the final hour of U.S. trading. Investors were fearful over the accelerating European debt crisis and more signals the recovery is losing steam.

The sell-off this week has pushed the S&P 500 below the so-called neckline of the topping pattern. [S&P 500 ETFs Test Support at Pattern ‘Neckline’]

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.