Foreclosures shot up a whopping 121% in one year, a percentage that could hold back exchange traded funds (ETFs) that focus on the real estate market.

About 220,000 homes were repossessed in the second quarter, triple the number from the same quarter last year, reports Les Christie for CNNMoney. The numbers have caused RealtyTrac to reevaluate its forecast, which had been 1.9 million to 2 million for the year. But not even halfway, there have already been 1.4 million foreclosures.

A government report showed today that single-family home sales were stronger than expected, and inventories shrank to their lowest level in three-and-a-half years. The 0.6% drop in sales was better than what analysts had expected, says Mark Felsenthal for Reuters.

Consumer confidence had been at 28-year lows, but the tax rebates boosted sentiment in July. The consumer confidence index rose to 61.2 in July, up from 56.4 in June. Forecasts had been for no change, reports Pedo Nicolaci da Costa for Reuters. The numbers point to a downturn in spending lasting into 2009, however.

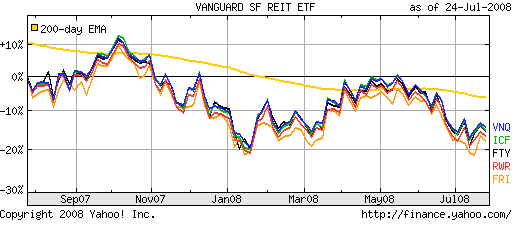

Real estate-related ETFs that could continue to be impacted by the housing crisis:

- Vanguard REIT (VNQ): up 4.2% year-to-date

- SPDR Dow Jones Wilshire REIT (RWR): up 3.7% year-to-date

- iShares Cohen & Steers Realty Majors (ICF): up 3.7% year-to-date

- iShares FTSE/NAREIT Real Estate 50 (FTY): up 2.3% year-to-date

- First Trust S&P REIT (FRI): up 2.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.