Some stocks and exchange traded funds (ETFs) are trading lower today after existing home sales fell in June.

The 2.6% drop was more than twice what had been expected, reports Martin Crutsinger for the Associated Press. Sales are also 15.5% below what they were a year ago.

Prices are continuing to slide, too: the median price for a home sold last month was $215,100, off by 6.1% from a year ago. It’s the fifth-largest year-over-year price drop on record.

Last week, it was announced that single-family homebuilding lost 5.3% in June.

On the upside, one economist feels that the housing rescue bill should help the housing market bounce back. The tax break it includes for first-time homebuyers could help sales.

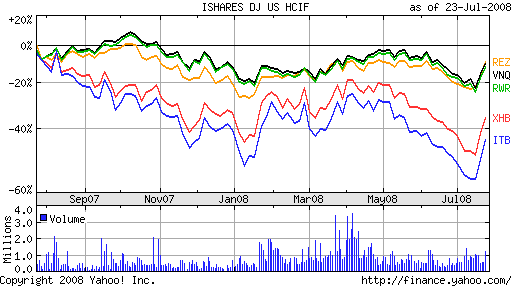

Home construction and real estate ETFs are trading lower this morning on the news:

- iShares Dow Jones US Home Construction (ITB), down 5.7% year-to-date

- SPDR S&P Homebuilders (XHB), down2.4% year-to-date

- DJ Wilshire REIT (RWR), down 3.7% year-to-date

- Vanguard REIT Vipers (VNQ), down 4.2% year-to-date

- iShares FTSE NAREIT Residential Index Fund (REZ), down 17.5% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.