Gold bullion holdings in the world’s largest gold exchange traded fund (ETF), SPDR Gold Shares (GLD), reported a net inflow of five tons for the second quarter, making for a total of 948 tons.

The price of gold averaged $896.29 an ounce in the quarter, reports Frank Tang for Reuters, $30 below its average price in the first quarter. As the dollar strengthens, gold loses its luster and it’s seen as less of a safe haven than it is in more turbulent times.

Spot gold hit a record $1,030.80 an ounce on March 17. Yesterday, the price was $964.60.

BGF World Mining Fund Manager Evy Hambro reports for Telegraph that as uncertainty in the markets remains, gold will retain its characteristics as a hedge. The long-term outlook remains favorable, while both jewelry and investment demand should remain strong while gold mine production falls or keeps the status quo.

Hambro says that estimates are that global gold mining production will fall by 10%-15% over the next five years, in part because of a lack of success in exploration. Gold’s attractiveness as a hedge coupled with geopolitical tensions should keep the supply and demand fundamentals favorable.

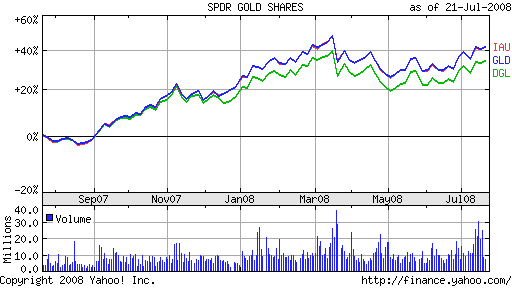

- iShares COMEX Gold Trust (IAU), up 15.5% year-to-date

- SPDR Gold Shares (GLD), up 15.5% year-to-date

- PowerShares DB Gold (DGL), up 13.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.