Technology exchange traded funds (ETFs) got a boost in early morning trading, apparently motivated by various reports about Yahoo (NASDAQ: YHOO) as a potential takeover target.

Shares of Yahoo’s main search market competitor – Google (NASDAQ: GOOG) – are also going up in anticipation of its quarterly financial results, which will be announced after the market close. It’s a good time for the tech giants: Apple’s (NASDAQ: AAPL) stock price reached $300 for the first time yesterday. Tech ETFs are up slightly this morning; Technology Select Sector SPDR (NYSEArca: XLK) is up 0.2% so far. Apple and Google are top holdings, while Yahoo is a smaller component. [Finding Values in Tech ETFs.]

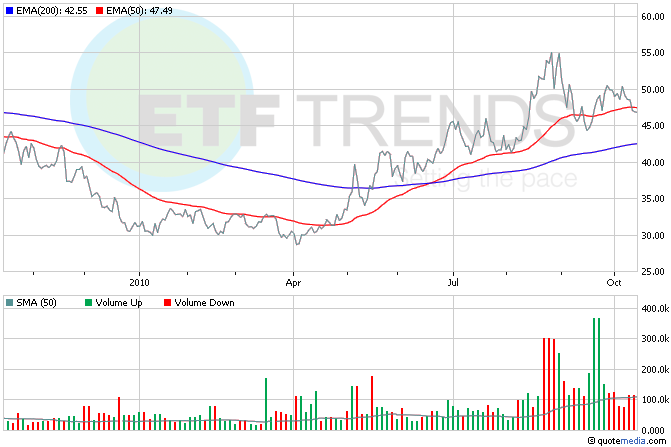

Gold is still charging upward, today reaching a new high of $1,388.10 an ounce. In the foreign currency news, the dollar is continuing to drop to new lows against the Yen and Euro. CurrencyShares Euro Trust (NYSEArca: FXE) is up nearly 1% in early trading. In the last three months, it has surged nearly 9%. [Europe ETFs: The Cup is Half-Full.]

Overall stocks are wavering in early trading after a disappointing job report released this morning. The government reported that unemployment benefits rose for the first time in three weeks. Typically, negative labor data would lead to sharply lower stock prices. Today this is not the case because any evidence of a sagging economy is viewed as further evidence the Federal Reserve will need to act very soon with stimulus. The minutes from the Fed meeting last month suggested that the currently rate of inflation was excessively low and that future bond purchases should help raise inflation back to more historically normal levels. The Direxion Daily 30-Year Treasury Bull 3x Shares (NYSEArca: TMF) is up about 0.2% so far today.

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.