The U.S. dollar exchange traded fund (ETF) is sinking like a lead balloon. As investors seek higher-yielding currencies, it’s bringing the Australian and Canadian dollars near parity with the greenback.

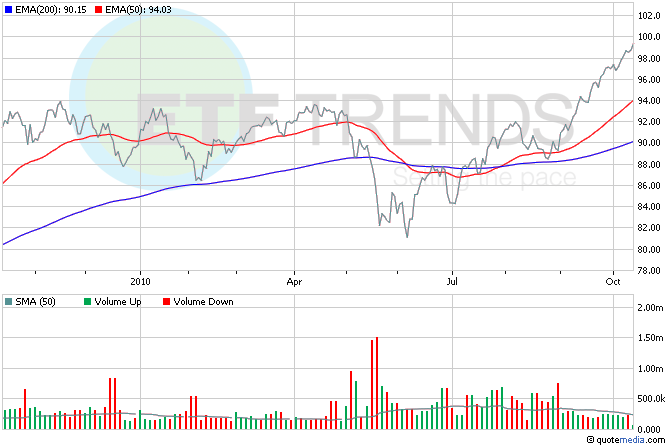

The U.S. dollar is now at a five-month low against Canada’s currency, while the Australian dollar surged to its highest point since it was floated in 1983, reports The Wall Street Journal. The moves have also pushed the PowerShares DB U.S. Dollar Bullish (NYSEArca: UUP) close to an all-time low.

What’s the big worry? The prospect of further quantitative easing by the Federal Reserve threatens to weaken the dollar further, putting traders in a firmly anti-dollar position.

- CurrencyShares Canadian Dollar Trust (NYSEArca: FXC)

- CurrencyShares Australian Dollar Trust (NYSEArca: FXA)

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.