Exchange traded funds (ETFs) that track metals companies are on the move up this morning spurred by a positive earnings report from JP Morgan (NYSE: JPM) as Wall Street rides a wave of optimism about the economic recovery.

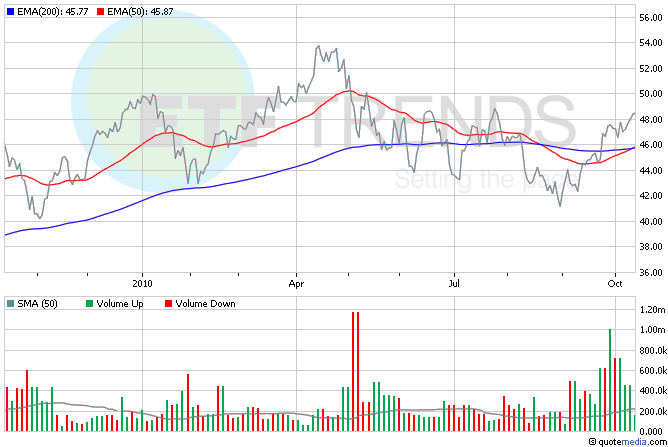

Metals ETFs are trading higher by as much as 3.8% this morning after a spate of earnings reports lifted Wall Street’s spirits. The top-moving ETF so far is First Trust ISE Global Copper (NASDAQ: CU), a fund that tracks the performance of the world’s copper miners.

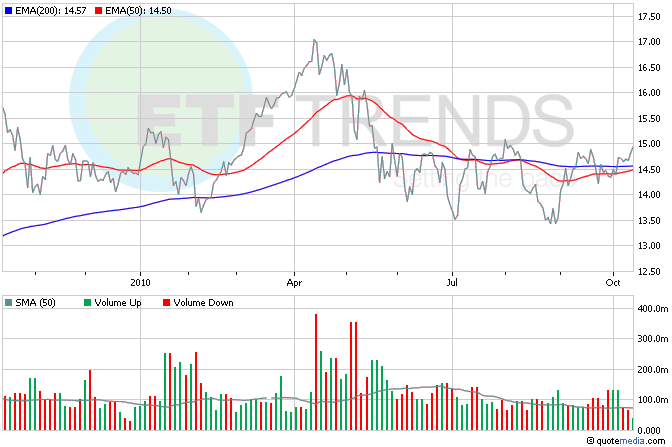

The second-largest U.S. bank reported a 22% jump in quarterly profits and lower loan losses. Financial Select Sector SPDR (NYSEArca: XLF) is up 0.7% so far this morning, but it’s down 12% in the last six months. JP Morgan is the top holding in the fund at 9.5%. [One ETF to Play Financial Reform.]

Technology company stocks are starting very strong today as Intel Corporation (NASDAQ: INTC), the world’s largest chip maker, forecast upbeat fourth-quarter sales and profits. Slow consumer spending was more than offset by demand from corporate customers and emerging markets. Also contributing to early the morning bounce in NASDAQ stocks are big numbers from Dutch chip equipment maker ASML Holding NV. ASML exceeded estimates with a big jump in quarterly profits and high expectations to end the year with record orders. iShares Goldman Sachs Semiconductor (NYSEArca: IGW) is flat so far this morning; Intel is 7.9% of the ETF. [Telecom and Tech ETFs Team Up.]

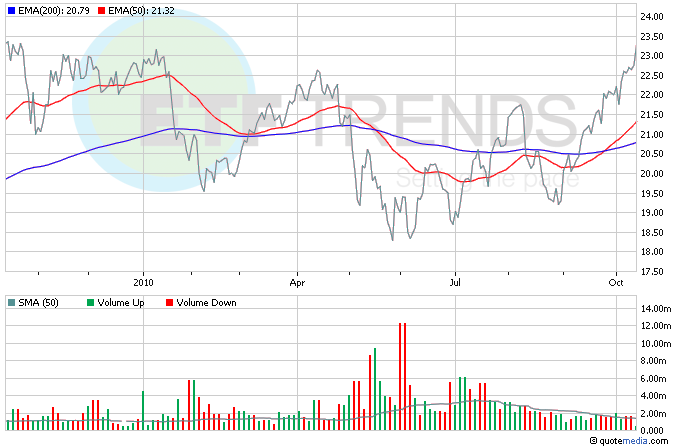

Asian and other European stock are going up this morning after U.S. Federal Reserve confirmed on Tuesday that it stands ready to provide additional monetary stimulus to jump start the stagnant U.S. economy. In early trading, the German DAX index of blue chip stocks reached its highest level since the September 2008 crash of Lehman Brothers. The iShares MSCI Germany (NYSEArca: EWG) is surging this morning as much as 2.5%. [Europe ETFs: Who’s Hot, Who’s Not.]

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.