While investors wait for earnings season to start later this week, stocks and exchange traded funds (ETFs) seemed to go limp following some weak economic reports.

According to the ETF Dashboard, investors are turning their attention both overseas and toward small-caps in early trading. One ETF leading the way so far is Market Vectors Egypt (NYSEArca: EGPT), which is up more than 2% on reports that the country’s leaders expect 6% growth this fiscal year.

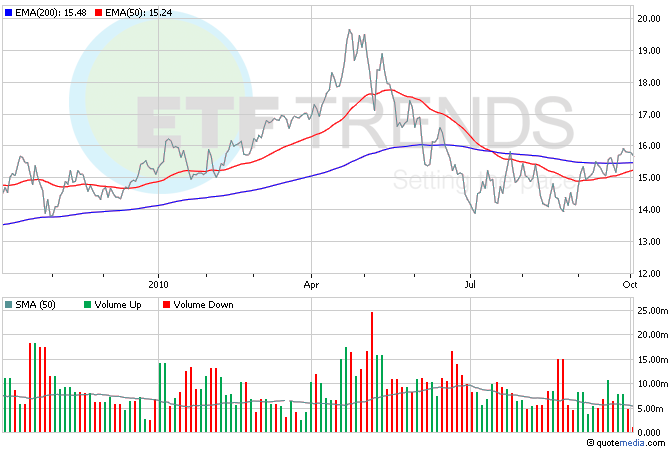

Pending home sales rose 4.3% in August, meaning a second consecutive month of improvement but still a sharp slowdown from last year’s sales pace. The reading is an early indicator of sales activity; it takes one to two months for a contract to close. SPDR S&P Homebuilders (NYSEArca: XHB) is down 0.6% so far today; in the last three months, it’s up 10.2%. [Tom Makes His Picks on CNBC.]

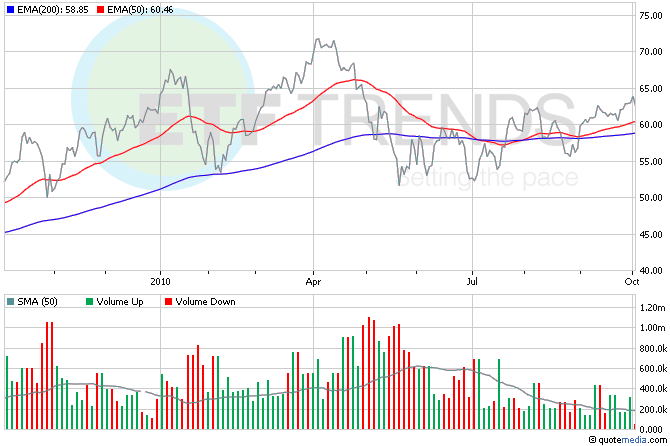

A steep drop in demand for commercial aircraft sent U.S. factory orders 0.5% lower; excluding those figures, however, orders rose for the first time since March, by 0.9%. Market Vectors Steel (NYSEArca: SLX) sank 2% lower following the reports, but it’s up 17.6% in the last three months. [Steel ETFs Trump Dour Forecasts.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.