The price of gold jumped to a four-month high, sending gold exchange traded funds (ETFs) higher.

A dash of record oil (now more than $147 a barrel), a heaping teaspoon of mortgage-company concerns and a pinch of a falling dollar stirred together combined to leave a bitter taste in investors’ mouths and sent them to gold in an effort to lose the aftertaste.

Wall Street particularly sputtered on news of Fannie Mae and Freddie Mac’s woes, reports Stevenson Jacobs for the Associated Press.

Some other commodities were trading lower, though. Agriculture futures fell, including those for corn and soybeans.

It’s just the latest run on the metal, which has seen prices rise 34% in the last year. However, it’s still sitting below the $1,000 mark that it reached in the wake of the Bear Stearns collapse. It closed today at $958.40 an ounce, which is the highest price since March 19.

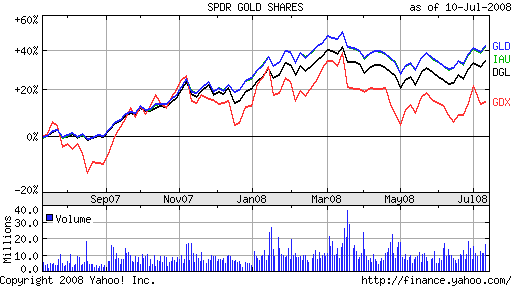

Gold ETFs that hold the metal and trade futures all rose higher today, including:

- SPDR Gold Shares (GLD), up 13.6% year-to-date

- iShares COMEX Gold Trust (IAU), up 13.2% year-to-date

- Market Vectors Gold Miners (GDX), up 1.8% year-to-date

- PowerShares DB Gold (DGL), up 11.5% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.