Second-quarter GDP was revised sharply downward this morning. But before the markets could worry too much, Federal Reserve Chairman Ben Bernanke stepped in with some reassuring words that were enough to sustain exchange traded funds (ETFs) and turn the markets positive in early trading.

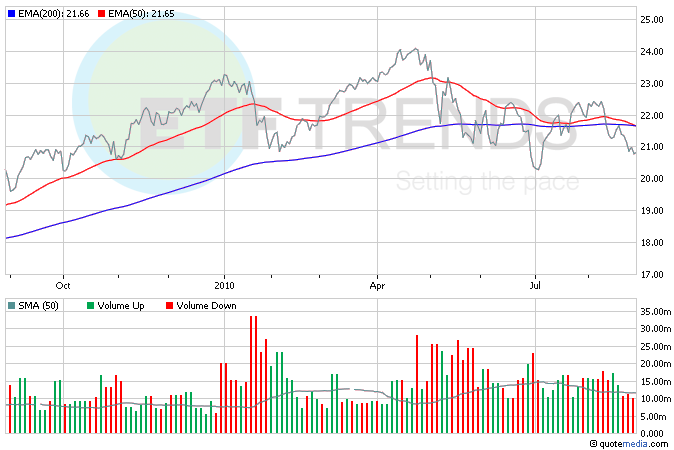

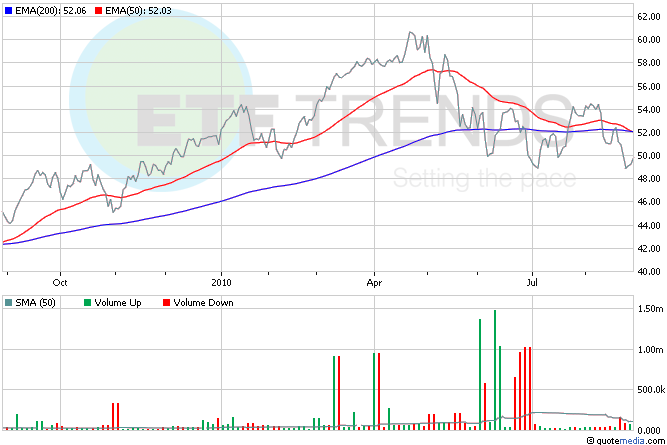

According to the ETF Dashboard, investors are flocking to global ETFs while they wait for the U.S. recovery to sort itself out. Leading the charge were a number of emerging markets funds, including iShares MSCI Thailand (NYSEArca: THD) and iShares MSCI Brazil (NYSEArca: EWZ), both of which are up around 2%.

After reports that GDP was revised downward to 1.6% in the second quarter, Federal Reserve Chairman said that the Fed would step in if the economy faltered. He didn’t elaborate on anything specific, but watchers say it would likely mean more purchases of securities such as Treasuries or mortgage securities.

Intel (NASDAQ: INTC) sent off some warning signs that could further weigh down the tech sector: the chip maker cut sales forecast for the third quarter. Back-to-school season hasn’t been the bonanza that many manufacturers and retailers had hoped it would be. Dell (NASDAQ: DELL) and Hewlett-Packard (NYSE: HPQ) have also both issued warnings about sales in recent days. Amid the news, Technology Select Sector SPDR (NYSEArca: XLK) has stayed flat this morning; in the last month, it’s down 7.4%. Intel is 4.2%; Dell is 1%; and HPQ is 3.6%. [Tech ETFs to Avoid If You’re Bearish Like Cisco.]

The 787 Dreamliner is having yet more trouble: the first delivery has been pushed to the middle of the first quarter of 2011 by Boeing (NYSE: BA). The issue involves engines that may not be available in time for a test flight later this year. iShares Dow Jones U.S. Aerospace & Defense (NYSEArca: ITA) is up 1% this morning despite the reports; perhaps delays had already been factored in, since Boeing has been warning this might happen. Boeing is 7.8% of ITA. [Defense Budget and ETFs: Possible Value?]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.