Orders for big-ticket items fell last month on falling demand for commercial aircraft, sending stocks and exchange traded funds (ETFs) slightly lower in early trading.

According to the ETF Analyzer, one of the top-moving funds early today is United States Natural Gas (NYSEArca: UNG), which is up about 4.1% on news that warmer weather could soon be boosting demand for this commodity. The industry may also get a major push from new legislation in Washington. [Summer Heat Lifts Natural Gas ETFs.]

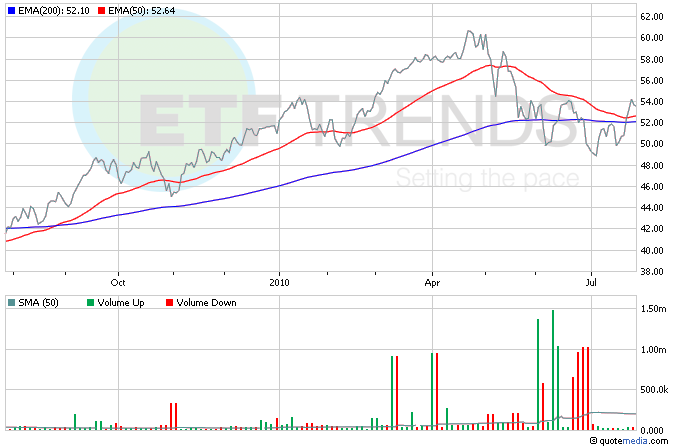

Orders for durable goods fell 1% in June, led by a huge drop of 25.6% in commercial aircraft orders. Business spending for machinery and equipment gained 0.6%, following a 4.6% jump the previous month. The best news is that orders in June were 16.5% higher than orders from a year ago. iShares Dow Jones U.S. Aerospace & Defense (NYSEArca: ITA) is down 0.3% in early trading; Boeing (NYSE: BA) is 7.9% of the ETF. Boeing also reported earnings this morning: Q2 profit fell 21%, actually topping expectations. [Boeing Could Lift Aerospace ETFs.]

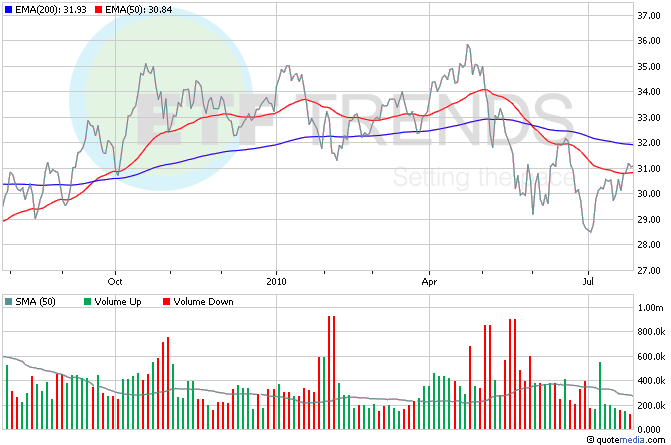

It’s a good day for big oil companies: ConocoPhillips (NYSE: COP) reported that its second-quarter income more than doubled on increasing oil prices. This week, BP (NYSE: BP), Valero (NYSE: VLO) Britain’s BG Group and Italy’s ENI also reported solid earnings for the quarter. iShares Dow Jones U.S. Energy Sector (NYSEArca: IYE) is up just slightly; Conoco is 6.2% of the fund; Valero is 0.8%. [How Not to Get Burned By Commodity ETFs.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.