Bank earnings reports went gangbusters this morning, pushing financials to be the top-performing sector in the S&P 500. Financial exchange traded funds (ETFs) traded a notch higher on the reports from Wells Fargo (NYSE: WFC), U.S. Bancorp (NYSE: USB) and Morgan Stanley (NYSE: MS).

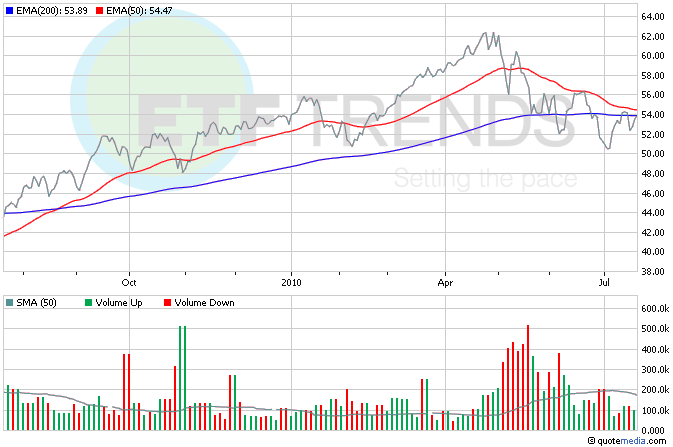

Wells Fargo’s second-quarter earnings rose 12%, topping estimates. U.S. Bancorp notched an earnings increase of 63% and Morgan Stanley’s earnings were up 53% from a year ago, also beating estimates. Financial Select Sector SPDR (NYSEArca: XLF) is up about 0.7% on the news; Wells Fargo is 8.6%; U.S. Bancorp is 2.8%; and Morgan Stanley is 2.2%. [5 Positives of Financial Reform.]

Good news from the manufacturing sector: three major manufacturers raised their profit targets for the year, expressing confidence in the industrial rebound. Earnings from United Technologies (NYSE: UTX), Textron (NYSE: TXT) and Eaton (NYSE: ETN) rose in the second quarter and beat expectations. United Technologies is 4% of iShares Dow Jones U.S. Industrials (NYSEArca: IYJ); Textron and Eaton are smaller weightings. [5 ETFs to Play Recovery.]

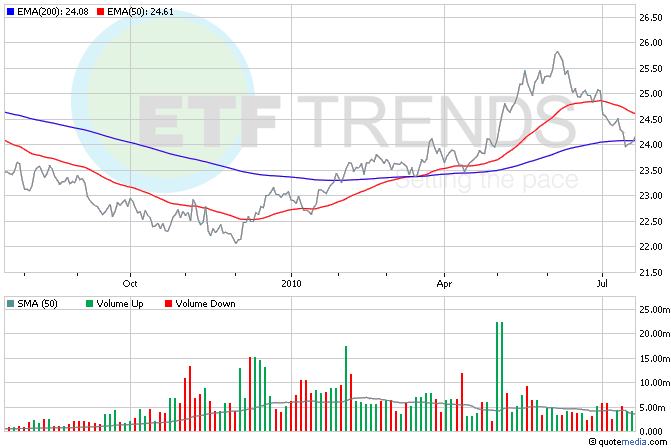

PowerShares DB U.S. Dollar Bullish (NYSEArca: UUP) is gaining in early trading while the markets await testimony from Federal Reserve Chairman Ben Bernanke, while the euro dipped slightly. Bernanke is expected to talk about the Fed’s downward revision to economic growth, inflation, the housing market and Europe’s foundering economy. [ETFs for Changing Sentiment.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.