Exchange traded funds (ETFs) are trading mostly flat alongside the broader markets while traders wait for earnings season to officially kick off after the closing bell with Alcoa (NYSE: AA). The technology sector was the lone standout, thanks to an upgrade for the sector.

Several technology companies got the boost, including Yahoo (NASDAQ: YHOO) and SanDisk (NASDAQ: SNDK), based on favorable risk/reward ratios and other positive factors. Microsoft (NASDAQ: MSFT) jumped after an announcement that it teamed up with Fujitsu on cloud computing. [Apple: King of the Nasdaq 100]

- First Trust NASDAQ-100 (NASDAQ: QTEC): Yahoo and Microsoft are 2.6% of the fund; SanDisk is 2.5%

Analysts may feel that earnings season will be a generally solid one, but investors aren’t so sure. That’s why they’re turning to the U.S. dollar in early trading, pushing it higher against a basket of other currencies. They’re also nervous about the results of European bank stress tests, which is pushing them out of the euro. [Currency ETFs: A Simpler Option.]

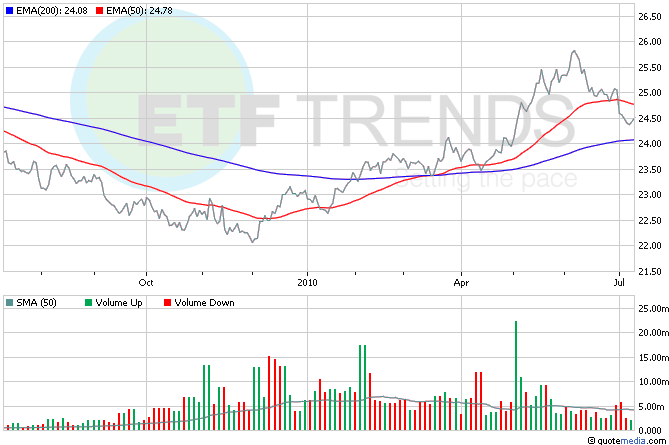

- PowerShares DB U.S. Dollar Index Bullish (NYSEArca: UUP) is up 0.3% so far this morning

When Alcoa reports earnings later today, it’s not expected to be a positive report. While the aluminum maker may show some profit and sales, there’s some pessimism about the broader aluminum market that may cause investors to curb their enthusiasm. Aluminum’s price has declined 12% since the start of the year, according to The Wall Street Journal. [The Price Impact of an Aluminum ETF.]

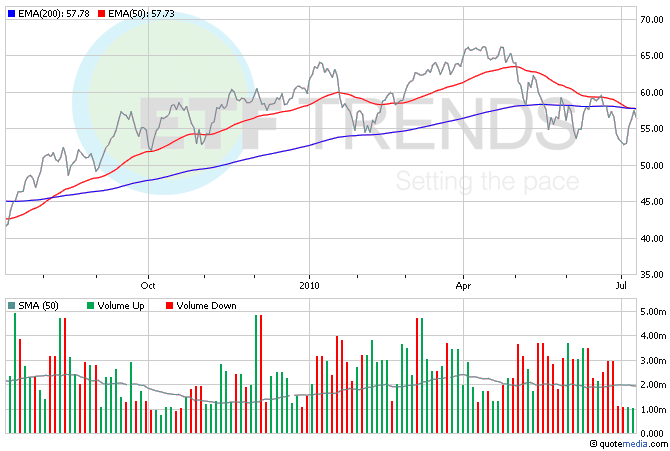

- iShares Dow Jones U.S. Basic Materials (NYSEArca: IYM): ahead of the earnings, IYM is down 1.8%; Alcoa is 3% of the fund

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.