Emerging market banks are well-capitalized, well-funded and growing rapidly. Brazil’s banks seem to be among the strongest of the bunch and the country has been the motor behind emerging financial exchange traded funds (ETFs).

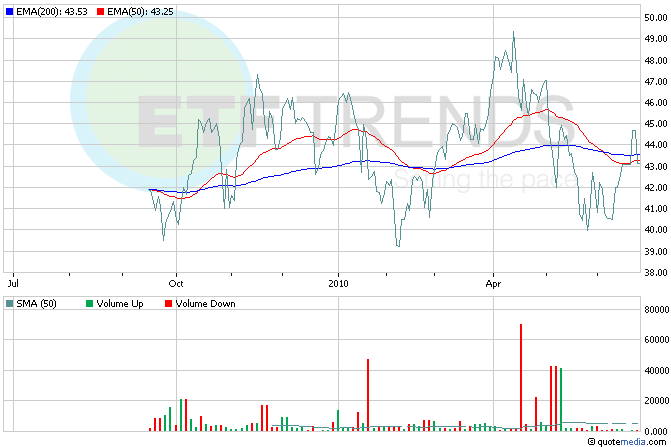

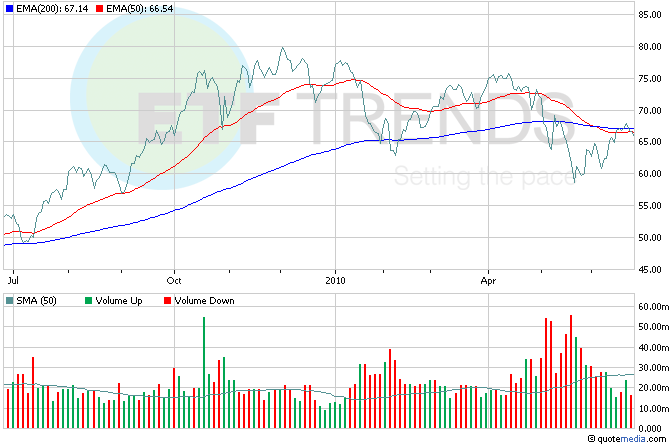

In the last month, both iShares MSCI Emerging Markets Financials Sector Index Fund (NYSEArca: EMFN) and Emerging Global Shares Emerging Market Financials (NYSEArca: EFN) are up 10% and 6.7%, respectively.

Brazil makes up a hefty portion of these funds: EMFN holds 14%in Brazil, while EFN holds 16.4% in the growing nation. iShares MSCI Brazil (NYSEArca: EWZ) also allocates a hefty portion to the country’s financial sector at 22.7% of the weighting. [Latin America’s ETF Hot Spots.]

Brazil’s total stock of bank credit climbed in May in the latest sign a credit expansion, which will help ignite more growth throughout the region. Ana Nicolaci da Costa and Isabel Versiani for Reuters reports that outstanding loans in Brazil’s banking system rose 2.1% in May from April, the central bank said on Wednesday, climbing to the equivalent of 45.3% of gross domestic product from 44.8% in April. [Emerging Market ETFs: The Benefit of Small-Caps.]

More available credit has increased demand for appliances, cars and housing, which helped the country’s economy grow 9% year-over-year in the first quarter. Brazil’s central bank sees credit growing 20% this year to become 48% of GDP.

For mores stories about Brazil, visit our Brazil category.

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.