Investors around the world have been bolstered by India’s economic progress and the growth seen in the country’s exchange traded funds (ETFs). But not everyone is singing the praises of the Tiger just yet.

The Vanguard team visited the country a few weeks back and was less than impressed by what it saw. Although India may have more mutual fund-ready customers than any other nation, the experts remain “unconvinced of the India opportunity,” Sean Hanna of Mutual Fund Wire reports. [Why the Tiger is Roaring in India.]

India’s Minister for Trade Anand Sharma is hoping the the country will see a growth rate of 8.5%-9%. Apparently, the country touts the largest middle class population now and the liberalization of foreign trade and investment norms has taken the country through rapid economic growth, explains Trade Minister on Daily Markets.

India sustained growth during the global economic crisis because of rising incomes, boosting the demand for cars, mobile telephones and many other consumer durables. [Why India ETFs Need Modernization.]

For more stories about India, visit our India category.

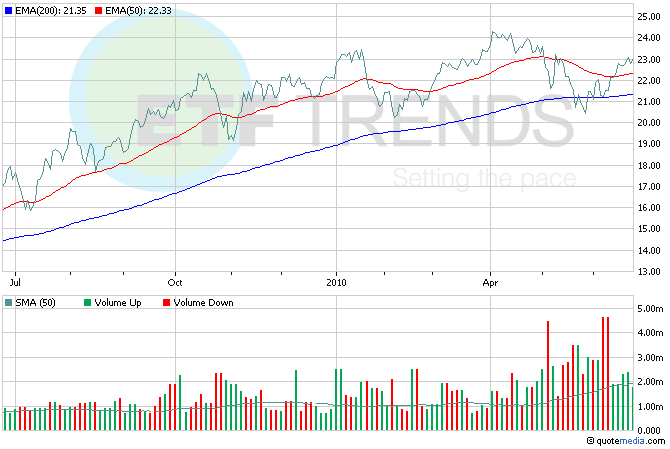

- PowerShares India (NYSEArca: PIN)

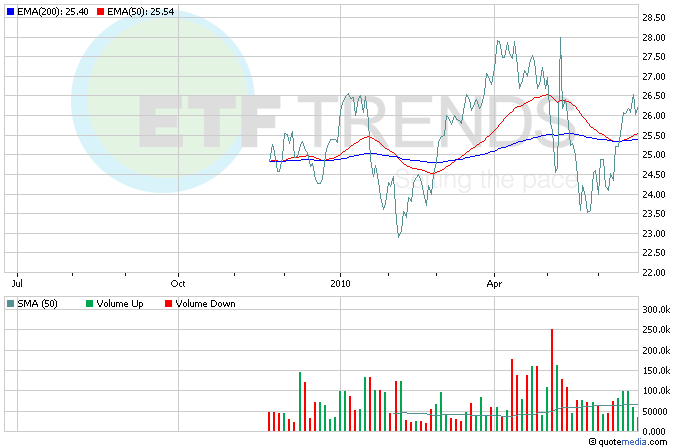

- WisdomTree India Earnings (NYSEArca: EPI)

- iShares S&P India Nifty 50 Index (NYSEArca: INDY)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.