Stocks and exchange-traded funds (ETFs) are both solidly in negative territory this morning as a stronger dollar, a downgrade on the semiconductor industry and mixed economic news weighed on investor sentiment.

The U.S. index of Leading Economic Indicators (LEI) rose 0.3% in October, marking the seventh consecutive monthly gain, while the Philly Fed regional survey of business activity rose to 16.7 in November, a bit better than expected, reports Bob Willis for Bloomberg. Claims for jobless benefits remained at a 10-month low.

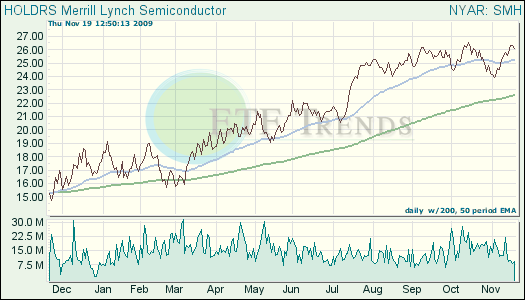

Semiconductor stocks are leading technology stocks lower after a downgrade on 10 semiconductor stocks, including Intel (NASDAQ: INTC) – which is down nearly 5.5% after the Bank of America/Merrill Lynch downgrade, reported Tenzin Pema for Reuters. Merrill said the supply of chips is growing faster than the demand, putting earnings at risk. So far in today’s trading, the Semiconductor HOLDRS (NYSE: SMH) is down about 4% and the SPDR S&P Semiconductor ETF (NYSE: XSD) is also down about 4%. (For more stories on the semiconductor industry, please see our semiconductor category).

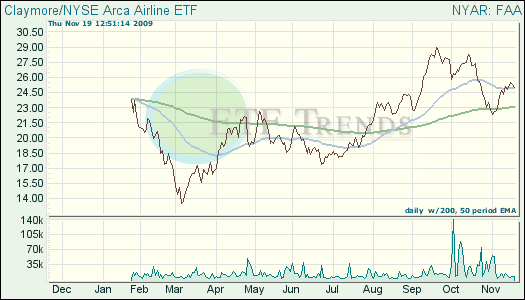

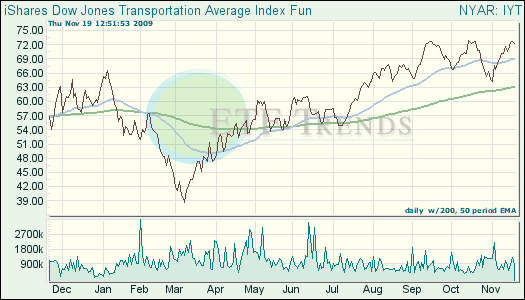

A computer glitch this morning at the Atlanta airport, the busiest in the nation, caused cascading flight delays across the nation, reported Brian Knowlton of The New York Times. Air traffic controllers were forced to program flight plans manually. So far in today’s trading, the iShares Dow Jones Transportation Average Index Fund (NYSE: IYT) is down nore than 2% and the Claymore/NYSE Arca Airline ETF (NYSE: FAA) is down more than 3%. (For more news on the airline industry, please see our airline category).

On the corporate front, there was more downbeat employment news. AOL, which is being spun off from Time Warner (NYSE: TWX), is asking their employee base of about 6,900 for 2,500 volunteers to be laid off, reports Nat Worden of the Dow Jones Newswires. If the voluntary program is unsuccessful, there will be involuntary layoffs announced by AOL. (For more stories on the media industry, see our media category).

Tony D’Altorio contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.