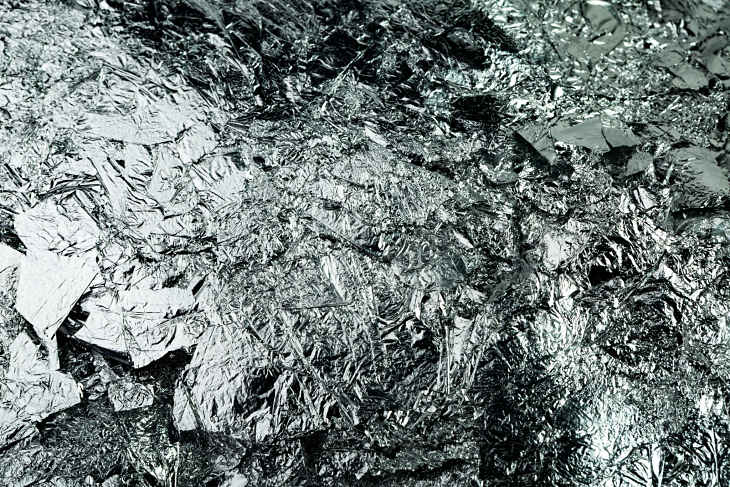

Silver is one of this year’s best-performing commodities, a fact highlighted by year-to-date gains of nearly 13% for the iShares Silver Trust (NYSEArca: SLV) and ETFS Physical Silver Shares (NYSEArca: SIVR).

However, inflows to silver ETFs have been mixed to start the year, indicating that some investors may be concerned about the impact of the Federal Reserve raising interest rates on silver and other commodities.

Silver and other precious metals enjoyed safe-haven demand as the equities market plunged into a correction. The Federal Reserve is targeting three interest rate hikes this year, which could white on precious metals, but some market observers believe there is upside to be had with the white metal.

“Instead of piling into the asset that’s offered the biggest gain among 22 raw materials on the Bloomberg Commodity Index this year, ETF investors are retreating. iShares Silver Trust, the biggest ETF backed by the metal, is poised for a fifth straight monthly outflow, a trend not seen since the fund listed in 2006. Holdings in all silver-backed ETFs tracked by Bloomberg have shrank by 6.2 million ounces and are near the lowest in seven months,” reports Luzi-Ann Javier for Bloomberg.