Supporting the ongoing rally in the crude oil market and energy-related exchange traded funds, producers outside of the Organization of Petroleum Exporting Countries agreed to join the cartel in curbing oil output to further support global prices.

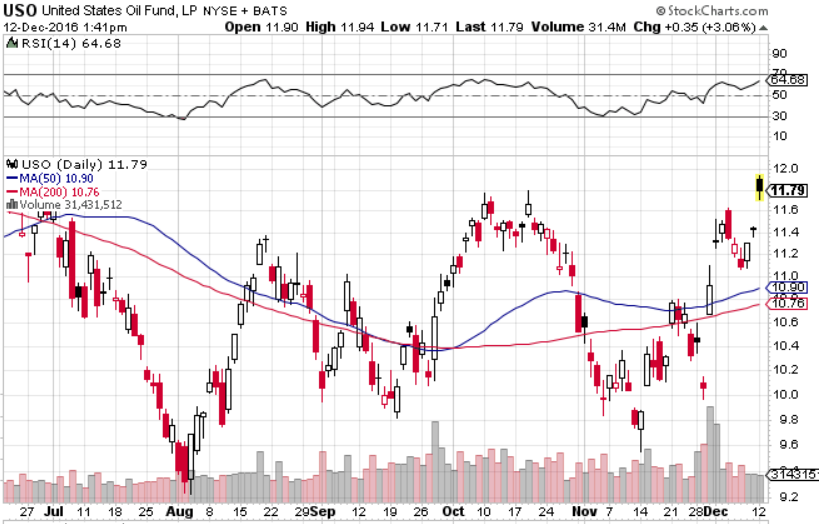

On Monday, the United States Oil Fund (NYSEArca: USO), which tracks West Texas Intermediate crude oil futures, gained 3.2% and the United States Brent Oil Fund (NYSEArca: BNO), which tracks Brent crude oil futures, rose 3.0%. Over the past month, USO increased 11.3% and BNO advanced 13.6%.

WTI crude oil futures were up 3.3% to $53.2 per barrel while Brent crude futures were 3.2% higher to $56.0 per barrel.

Meanwhile, the ProShares Ultra Bloomberg Crude Oil (NYSEArca: UCO), which takes two times or 200% daily performance of WTI crude oil, jumped 6.2% on Monday.

Fueling the oil prices gains on Monday, a group of large producers outside of OPEC, including Russia, agreed to scale back output by 558,000 barrels per day, with the bulk of the cuts – 300,000 barrels per day – pledged by Russia, the Wall Street Journal reports.