By Grant Engelbart, CLS Investments

Currently, there is approximately $45 billion invested in alternative ETFs, according to Morningstar – just 2% of total ETF assets. Investors have been slow to adopt these products. In some cases, their hesitance is for good reason, but in others, it stems from a lack of understanding and implementation guidance. There are a number of reasons alternative ETFs have been avoided during their limited history; however, those reasons may face strong resistance going forward.

Since the 2008 financial crisis, there has been a consistent trend of positive bond and stock returns, with only a few years suffering major declines. Because of this, investors have had little reason to stray from traditional asset classes into the abyss of alternative products, let alone relatively new alternative ETFs. However, along the way there have been some glimmers of hope that may provide insight into the future.

The definition of what constitutes an alternative ETF varies widely. As defined by Morningstar, alternative ETFs can encompass nearly any product that contains derivatives – including leveraged ETFs, VIX products, currencies, and hedged equity. However, investors would be wise to focus on traditional alternative categories, such as long/short equity, managed futures, market neutral, and multi-alternative products. The goal of adding alternative products into a traditional, balanced portfolio is to take advantage of uncorrelated sources of return, enhancing risk management in portfolio construction. With proper diligence, one can find ETFs that exhibit these characteristics, despite criticism that implies otherwise.

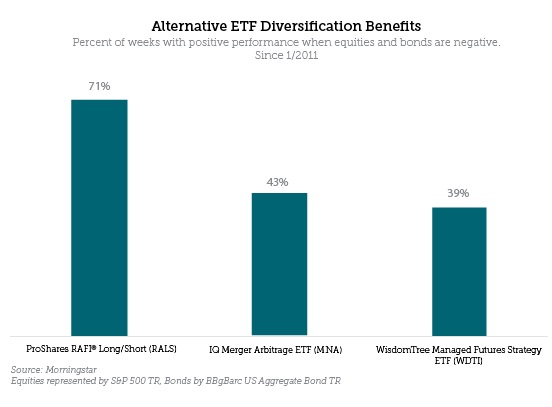

Balanced portfolios of equities and fixed income have had significant tailwinds in recent years, and in situations where one component sputters (stocks fall or interest rates rise), the other has been there to offset it. However, with the Federal Reserve (Fed) having raised interest rates for the first time in a decade, the scenario of rising rates and falling stock prices may occur more often. This is where uncorrelated alternative strategies can be especially beneficial. Below is a sample of three ETFs in the long/short, market neutral, and managed futures categories. These categories have had low correlations to stocks and bonds and maintained standard deviations only slightly higher than fixed income. The chart indicates the percentage of weeks that these ETFs have had positive returns when the S&P 500 and U.S. Aggregate Bond indices have both been negative.