By Chris Konstantinos, RiverFront Investment Group Director of International Portfolio Management

After meeting with investors across both coasts for much of the last two weeks, our conversations could best be described as ‘all Trump, all the time’ with regards to queries and concerns.

This reaction is understandable: even omitting discussion around social policy, the election of Donald Trump in the US may in fact represent a sea change for US economic policy, with wide-reaching potential impacts on growth, taxes and trade. In past Weekly Views and in our 2017 Outlook, we have detailed our thoughts on the possible economic effects of “Trumponomics” on the US, as well as on China and other emerging markets.

But what about its likely effects across the rest of the developed international markets, i.e. Europe and Japan? Let us first examine the reasons for caution on international stocks in the era of Trump and recognize that they are well-publicized. President Trump appears to be dismissive (if not antagonistic) towards the concept of a united Europe, distancing himself from leaders like Germany’s Angela Merkel even as he praises the populist-leaning Brexit movement in the UK. We do not think Trump’s support for anti-Euro parties is likely to influence European voters, but we recognize that a victory by Marine Le Pen in the French election could have wide-ranging implications for the future of the euro. We believe it is too soon to handicap the outcome. Secondly, markets highly dependent on global trade, such as Germany and Japan, could be impacted by the implementation of protectionist policies like a US border tax adjustment (discussed in last week’s January 23rd Weekly View), should it occur. Thus, we think that policy uncertainty is the main reason for caution.

Despite this uncertainty, in today’s piece we want to lay out why we believe Trumponomics will actually prove to be a net positive for equities in Europe and Japan.

REASON 1: TRUMPONOMICS IS CURRENTLY DRIVING A STRONGER DOLLAR… GOOD FOR EUROPE AND JAPAN EXPORTERS

The US dollar is up approximately +9% since the election versus the Japanese yen, and +3% relative to the euro (through January 27, 2017). Taken in aggregate, Trump’s focus on tax stimulus, pro-growth infrastructure spending, deregulation in key industries like energy and financial services, and protectionist trade leanings will all likely continue to place upward pressure on the U.S. dollar relative to many developed and emerging currencies. In addition, we have to acknowledge the possibility that Trump remakes the Fed into a more hawkish-leaning institution given the four seats open for presidential appointment (including the FOMC chairman) through 2018. This could have the effect of driving U.S. interest rates higher, another potential reason the dollar can stay strong. We believe Japanese and Eurozone exporters would continue to respond positively to a weak home currency, given the boost to relative competitiveness. We acknowledge that Trump himself said last week that he prefers a weak US dollar, but what a politician says is not nearly as impactful as what he does…and we think his cabinet’s policies suggest dollar strength.

REASON 2: TRUMPONOMICS IS PRO-GROWTH…AND NOT JUST FOR THE U.S.

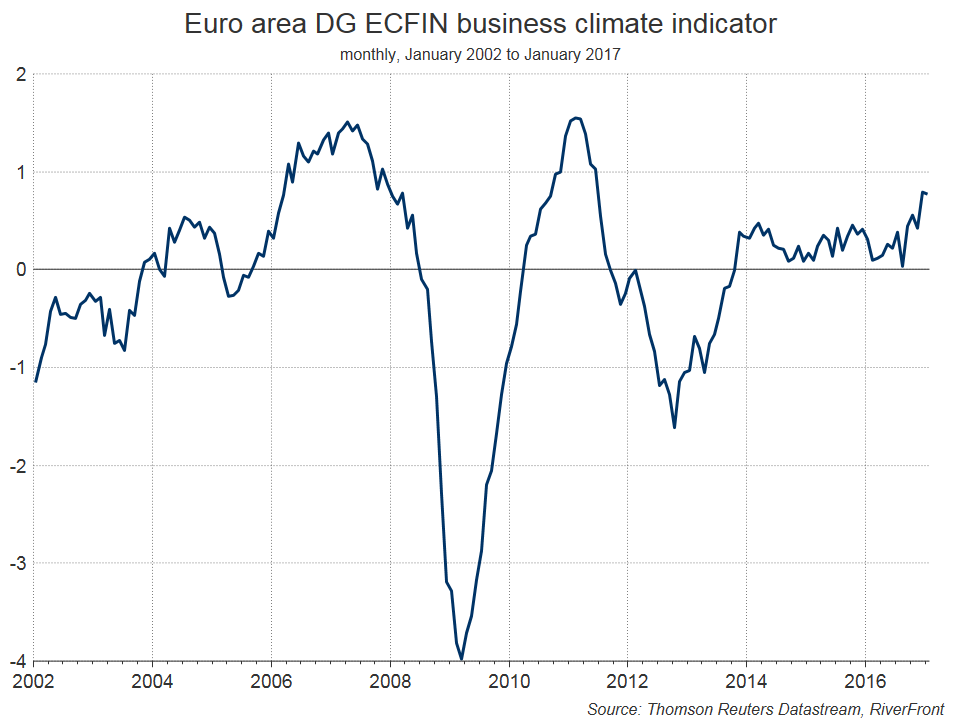

As highlighted in last week’s publication, small business optimism spiked sharply to a decade high in the US in the wake of the presidential election. We believe that excitement over tax breaks and less onerous regulation could unleash a virtuous cycle among hiring and capital expenditure among small and medium size businesses. This is a positive not only for corporate America but also for large-cap companies in Japan and the Eurozone, for which the US is an important export market. What’s also fascinating is that this optimistic impulse is not just a US-specific trend; business climate surveys in the euro area hit multi-year highs over the last 4 months or so (see Chart of the Week, next page.) Other broad economic indicators, such as manufacturing purchasing managers (PMI) surveys in the Eurozone and Japan, are also at highs not seen in 5+ years, and the Citigroup Economic Surprise Index (CESI) for G10 economies is also at a multi-year high. In short, we think high quality export-oriented companies in the Eurozone and Japan are likely to benefit more from stronger global economic growth than they are to be hurt by the protectionist-leaning parts of Trumponomics.

CHART OF THE WEEK: EURO AREA BUSINESS CONFIDENCE UP SHARPLY SINCE THE SUMMER

Source: Thomson Reuters Datastream, RiverFront Investment Group. Past performance is no guarantee of future results. The Directorate General for Economic and Financial Affairs Business Climate Indicator is calculated in order to receive a timely composite indicator for the manufacturing sector in the euro area. The indicator uses, as input series, five balances of opinion from the industry survey: production trends in recent months, order books, export order books, stocks and production expectations.