By Henry Ma, Julex Capital Management, President and CIO

Tactical asset allocation (TAA) is a dynamic strategy that actively adjusts the asset weights in a portfolio based on the manager’s short term market views. It is normally used as a complement to a strategic allocation in order to improve the risk/return profile of the total portfolio.

Historically, TAA provides an efficient and cost effective portfolio solution for managing downside risk. Therefore, following the financial crisis of 2007-2008, there was a renewed interest in these strategies as investors searched for better risk management tools.

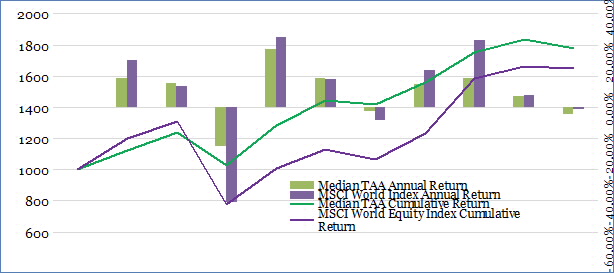

As shown in Figure 1, median TAA managers helped limit losses during down markets over the last ten years, which led them to outperform the MSCI World Equity Index over the same time period.

Figure 1: Historical Returns of Median Tactical ETF Strategy vs. MSCI World Index