Wing T 69 Bootleg Right, on two, ready….!

“In life, as in football, you won’t go far unless you know where the goal posts are.” – Arnold Glasow. The same can be said for investment management and implementing a sound program of asset allocation using ETFs. The first ETF (SPY) in the U.S. was introduced in 1993 and quickly grew as both individual investors (“players”) and financial advisors (“coaches”) helped drive the explosive growth in the industry. This growth and the changes in the industry can be likened to changes in football. The National Football League (NFL) playoffs are currently underway and the game has seen its share of changes over the years, just like the ETF industry.

So how do ETFs stack up against the gridiron? As mentioned previously, there has been a tremendous amount of growth in the business both in the number of ETFs and assets under management. Per the Investment Company Institute, there were nearly 6625 ETFs offered worldwide at the end of November 2016 – a far cry from the single ETF back in 1993. (Source:ETFGI.com) Compare that to the size of an NFL playbook and the changes it has witnessed over the years. The 1966 Super Bowl I champion Green Bay Packers, under the leadership of Vince Lombardi, sported an offensive playbook that was 45 pages long (Source: footballxos.com). Fast forward over the years, and the size of the modern-day playbook resembles more of a phone book now. Many teams are now opting to trade in their 500 page 3-ring binders in for iPads and tablets.

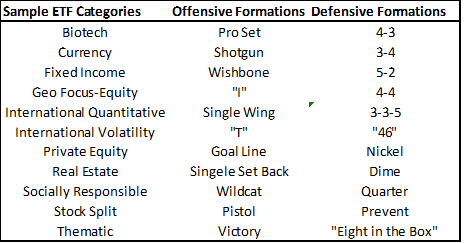

ETFs offer over 100 different categories of investments ranging from Aerospace and Defense to Volatility. They can all be subdivided into larger groups that fall within domestic broad-based, domestic sector/industry, hybrid, and bonds. Not interested in domestic ETFs? Well there are plenty of options in the international playing field as well just like a fan could turn to Canadian Football or perhaps Australian rules football. The categories of ETFs, such as large-cap, small cap, and commodities resemble football formations and as investor appetites or game situations change over time, the allocation, or formation used can also change. The formations describe how a team is lined up on the field to achieve their overall objective just like the category of ETF states the overall objective. Below is just a sample of ETF categories and football formations.

Large cap ETFs could be considered a staple to portfolio construction just like the T formation in football was a forerunner to many of the offensive formations we see today. George Halas is credited with perfecting the T formation in the 1940s. However, the T formation is rarely used now as the game has changed, just as ETFs today offer much more than just large cap variations. In the 1980s, the run and shoot offense was popular and employed by such teams as the Detroit Lions and the Houston Oilers but is no longer a primary offensive formation and teams opt to employ a “hybrid” instead. The Pro Set formation, or West Coast Offense, was made famous by Bill Walsh and his San Francisco 49ers but is no longer as prominent as it once was. Remember the Wild Cat formation introduced by the Miami Dolphins in 2008? Many different teams implemented their own version of the formation at first, but has been rarely seen since. ETFs also undergo cycles of popularity. For instance, investors today have driven demand for ETFs that provide Smart Beta or exposure to different types of volatility. None of the formations mentioned have disappeared altogether; they are just not as popular as they once were because of the changing landscape. The shotgun formation was invented in 1960 and is very much in use today just like the very first ETF, SPY, still has more assets under management than any other ETF.

Under each formation there are a myriad of plays just as there are many individual ETFs under each category. If you desire large-cap exposure, there are nearly 90 ETFs that will do this both offensively and defensively and with varied degrees of leverage. This gives many players and coaches the ability to get more aggressive offensively by implementing leveraged ETFs or perhaps inverse correlated ETFs for those that want to play a little more defense. Don’t forget “special teams” or thematic style ETFs as well. A typical NFL playbook may have somewhere between 500 and 1000 plays with 800 being about average. However, in any given week teams are ready to execute roughly 100 plays and throughout the season may only use up to 250 different plays. The key is to move the ball downfield by having a sound “game plan” that incorporates both offensive and defensive combinations. This goal can be achieved with proper planning and execution under a variety of factors. Proper asset allocation is about investing in a mixture of asset classes to reduce risk and position yourself for victory. Understanding your investment objectives and time horizon is analogous to understanding your team’s personnel and their abilities.

There are nearly an unlimited number of football formations and plays like there are many ETFs to choose from when constructing a portfolio. The great Vince Lombardi once said, ”Football is like life. It requires perseverance, self-denial, hard work, sacrifice, dedication, and respect for authority.” The same can be said of portfolio management and a sound approach to investing.

Chris Hausman, CMT, is Director of Risk Management and Chief Technical Strategist for Swan Global Investments, a participant in the ETF Strategist Channel.

Disclosures:

Swan Global Investments is a SEC registered investment advisor providing asset management services utilizing the Swan Defined Risk Strategy, allowing our clients to grow wealth while protecting capital. Please note that registration of the Advisor does not imply a certain level of skill or training. Swan Global Investments, LLC is affiliated with Swan Capital Management, LLC, Swan Global Management, LLC and Swan Wealth Management, LLC. Disclosure notice and privacy policy.