Count master limited partnerships (MLPs) and the related exchange traded products among the asset classes benefiting from Donald Trump being in the White House. That includes the Global X MLP ETF (NYSEArca: MLPA), which gained more than 3% last week to push its one-year gain north of 34%.

Last week, MLPs strengthened after Trump took steps to advance the Keystone XL and Dakota Access pipelines, revealing the new administrations looser constraints on the oil industry, Bloomberg reports.

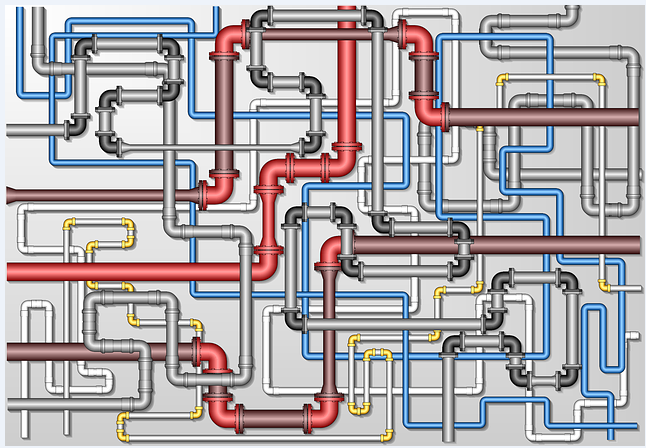

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, MLPs have historically shown a weaker correlation to energy prices over longer periods as MLPs act more like energy toll roads, profiting on the volume of oil moving through their pipelines.

MLPs don’t make their money based on oil or gas prices. Unlike other energy sector stocks, MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they are able to move around.