By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

With the U.S. Presidential election in the rear-view mirror, and Republicans maintaining control of both the House and Senate, expansionary policies are likely to drive the demand side of the inflation equation.

This should have implications for the pace of rate hikes as the U.S. Federal Reserve (the Fed) attempts to contain inflation. We have already seen headline inflation numbers trend upward with supply side price pressure coming from oil and rents.

At this point, measured rate increases from the Fed are expected. However, a lot will depend on the success of fiscal stimulus to drive demand, therefore, changing the pace of the Fed. Given this backdrop, we believe fixed income investors face volatility in the near-term, as oil prices find stability. Additionally, volatility over the next several years is a concern as the balance is found between fiscal and monetary policy.

Mounting Inflationary Pressures

Inflation, which is a key driver of interest rates and Fed Policy, is caused by demand and supply side pressures. Demand side inflation is generally caused by an easing of monetary conditions or economic growth, which leads to increased spending by consumers, thus driving prices up. Supply side inflation occurs when the cost of a good rises due to scarcity or other factors that impact the availability of that good.

With the Trump administration’s proposed expansionary fiscal policy, demand side inflation could be driven by tax cuts for individuals and corporations, which would put more money in the economy. This increases consumption and prices. Additionally, proposed increases in government spending on infrastructure would create further demand side pressure.

On the supply side, we have seen inflation trend up as oil prices have rebounded from their lows, as well as the recent news of OPEC’s agreement to production cuts. Rents have also trended upward due to the scarcity of rental units as construction has lagged demographic shifts over the past few years.

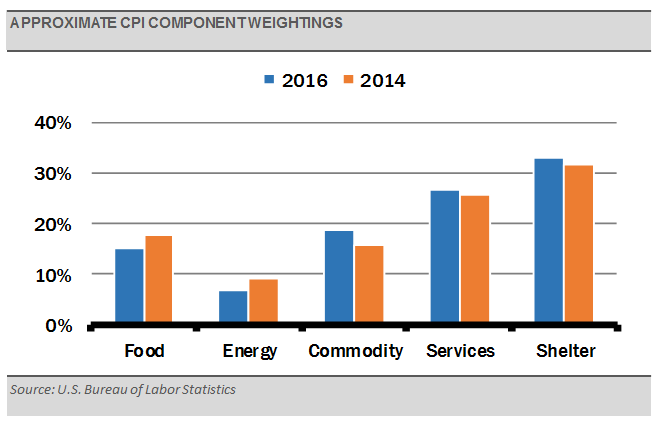

Inflation indices measure the price of a basket of goods that the typical consumer purchases. The weight of these goods in the index will vary over time with their relative importance. For example, rent gets a higher weighting due to its heftier portion of the typical consumer’s budget. As can been seen in the chart below, rising rents (shelter) have pushed the weighting up over time, with a sharper increase more recently as supply is lagging. This, coupled with a rebound in oil prices this year, has led to an uptick in the Consumer Price Index (headline CPI).

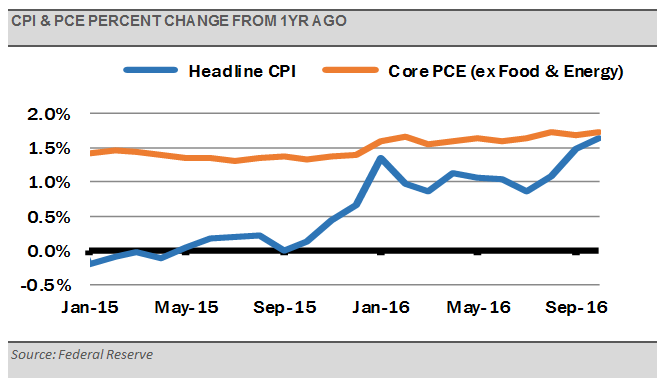

While headline inflation indices measure the price of all goods and services in the consumption basket, and have implications for inflation expectations and nominal interest rates, core inflation indices exclude the more volatile food and energy components. However, both methods include rents. The Fed has stated that they prefer to follow Core PCE, since it is “most consistent over the longer run with the Federal Reserve’s statutory mandate.” (FOMC Press Release 1/25/12).

While Core PCE, the Fed’s favored measure, has trended upward, it has been more stable and remains below the Fed’s 2% target rate. Since it excludes oil, it would not be impacted from oil price increases. Conversely, headline CPI does include oil and has continued to trend upward for several months.