By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Now that the presidential election is behind us, we can look next to the U.S. Federal Reserve’s (Fed) interest rate decision at their December 13-14 meeting, and what we might expect from the new Presidential Administration taking over in January. Putting risk first, we are most concerned with the implications of Fed policy.

Our primary risk when examining an economy is central bank policy. As the central bank for the largest economy in the world, the Fed is the most powerful central bank, and we pay particular attention to their policy.

You might recall how concerned we were last year as the Fed talked about raising interest rates at that time. We responded to those concerns by significantly reducing risk across our strategies. Fast forward to the current period, and we are much less concerned about the implications of an interest rate increase.

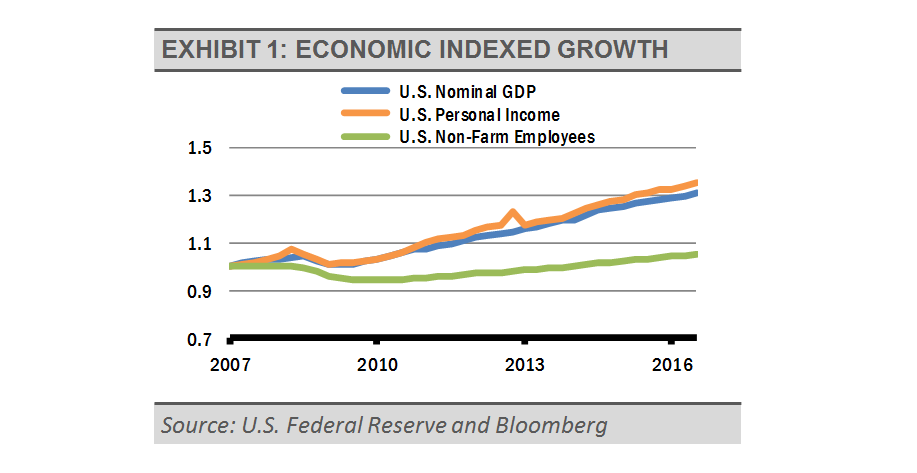

Compared with one year ago, the U.S. economy is larger, with millions more people employed, and aggregate income is higher.

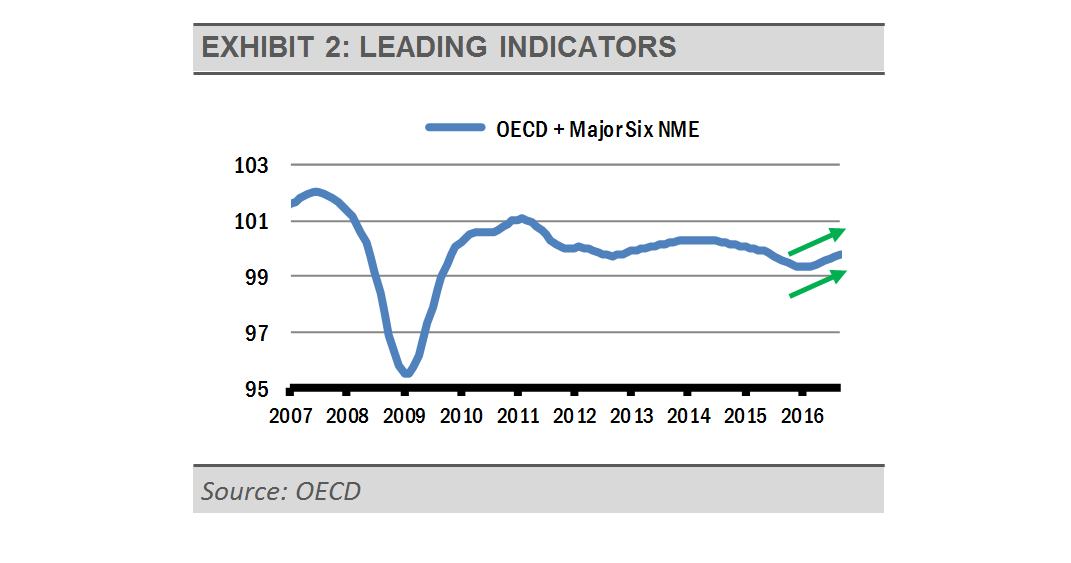

We are seeing similar signs of economic strength globally, as represented in the following graph of the OECD Composite of Leading Economic Indicators (LEIs) for OECD + Major 6 Non Member Countries. The OECD + Non-member economies covers all OECD countries plus the 6 non-member economies: Brazil, China, India, Indonesia, Russian Federation, and South Africa.

The recent uptick in LEIs is led by ongoing stability in the U.S., a firming of China’s economic growth, as well as an end to the recession in Russia and recent depression in Brazil.