Throughout the first part of 2016, Dividend ETFs were all the rage.

Performance was very strong and investors were seemingly piling money into these dividend payers. While the strong performance has leveled off in the latter half of this year, dividend ETFs still seem to be gaining flow (or at least not seeing outflows as could be expected given relative performance).

Some of the recent relative underperformance of dividend payers can be attributed to a somewhat higher interest rate environment. After plummeting over the first half of 2016, rates reversed course and have seen a rather steady uptick since June. As the Federal Reserve looks to raise its target later this year, this rate increase could persist heading into 2017. If that were to happen, dividend ETFs could continue to lag.

Fidelity has taken measures to neutralize this effect of rate increases on relative performance via the release of FDRR – Fidelity Dividend ETF for Rising Rates. In the following, I will dig a bit deeper into this new ETF and how it differs from some of its other Dividend ETF brethren.

To start, FDRR is part of Fidelity’s new suite of Factor ETFs. So as in some of their other names, it will take a multifactor approach in building out exposure. For FDRR, the first three factors include:

- Dividend Yield

- Payout Ratio

- Dividend Growth

While these in and of themselves are not unusual factors to analyze for dividend payers, Fidelity also includes a fourth factor that is the differentiator:

Correlation to 10-Year Treasury Yields

In this, they are identifying companies that have a positive correlation to rising rates (i.e. anticipated to perform better as rates rise) as compared to others in its investible universe.

To go along with this rate correlation factor, another differentiator in FDRR is sector neutrality. One aspect (or complaint depending who you ask) of dividend ETFs is the potential of sizable overweights to sectors such as Utilities. These sectors have shown to outperform when rates decline and vice versa. By neutralizing the sector weights (as compared to the Russell 1000), FDRR looks to add an additional layer of protection against rising rates as compared to other dividend ETFs.

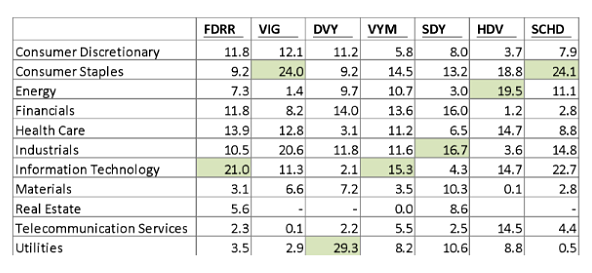

To compare, here is an analysis of FDRR’s sector exposure as compared to the top six US dividend ETFs by size (using exposure data from Bloomberg as of 10/18/2016):

VIG – Vanguard Dividend Appreciation

DVY – iShares Select Dividend

VYM – Vanguard High Dividend Yield

SDY – SPDR S&P Dividend

HDV – iShares Core High Dividend

SCHD – Schwab US Dividend Equity

This first table is an absolute exposure to the GICS sectors:

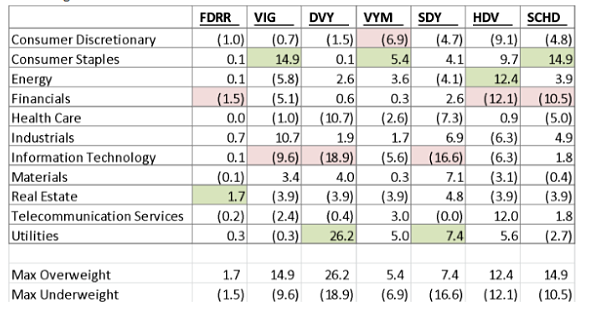

Conversely, here is a view of each name’s sector exposure as compared to the Russell 1000, which FDRR uses as it base index to determine sector weightings, with the max overweight in green and max underweight in red:

As you can see, compared to these other names, an exposure that stands out is the relative weighting to Technology. Whereas the other dividend names have a lower technology exposure based on the characteristics of the names in the sector, FDRR maintains a higher weighting. Conversely, FDRR maintains a relative underweight to both Utilities and Consumer Staples as compared to the other names.