Note: This article appears on the ETFtrends.com Strategist Channel

By Justin Sibears

In Newfound Research’s opinion, certain alternative strategies (e.g. managed futures and merger arbitrage) deserve to be considered for inclusion in many investor portfolios. These strategies offer access to unique return streams that tend to be quite diversified to core stocks and bonds.

Traditionally, investors accessed these types of strategies through hedge funds or other private investment vehicles. These vehicles can come with a number of drawbacks including limited liquidity, a lack of transparency, low regulation, and high fees.

Asset managers, in response to these investor concerns, have increasingly begun to offer alternatives strategies wrapped in more liquid formats such as mutual funds and ETFs. In the 10-year period from 2001 to 2010, 126 alternative mutual funds and ETFs were launched. Issuance subsequently skyrocketed to 208 funds in the four years through 2014.

While these liquid variants offer a number of advantages to their less liquid cousins, they are not perfect. This is especially true of liquid alternative ETFs, many of which suffer from a volatility problem.

When you hear volatility problem, you probably assume I mean that volatilities of these strategies are too high. But, I actually mean the exact opposite.

Related: Three Considerations for One-Stop Income Shopping

Because many liquid alternative ETFs employ strategies that are not 100% long risky asset classes and do not utilize leverage, they end up having volatilities that are closer to bonds than stocks.

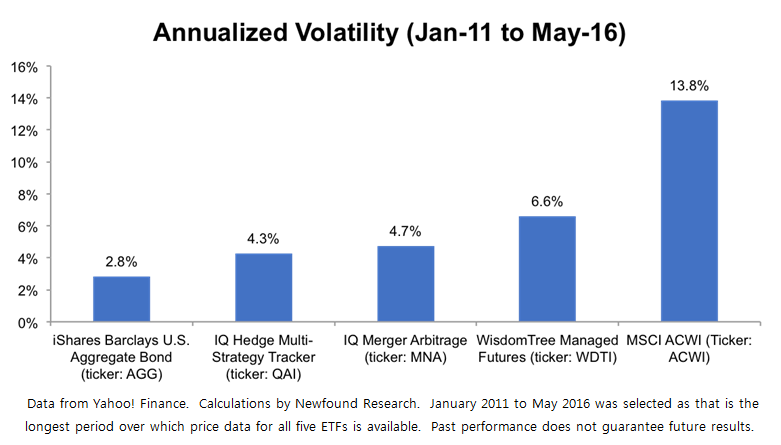

Below, we plot the annualized volatility for the three largest ETFs in ETFdb.com’s “Hedge Fund ETF” category over their shared history. We also provide this data for U.S. stocks and bonds as points of reference.

So why is low volatility a problem?

If we assume that Sharpe ratios are roughly equal across asset classes and strategies, then adding a liquid alternative ETF with lower volatility than the existing portfolio will necessarily reduce expected return. (Note: This statement assumes that we sell existing holdings in proportion to their allocation in order to fund the purchase of the new position.) Even though risk-adjusted returns may increase with the addition of the alternative strategy, in a low growth market environment, maintaining the level of expected returns may be more critical.

As an example, assume that an investor’s current portfolio and the liquid alternative ETF under consideration have expected volatilities of 10% and 5%, respectively. (Note: 5% is roughly the average historical volatility of QAI, MNA, and WDTI).

Related: Most Hated Bull Market in History – Something’s Gotta Give