Note: This article appears on the ETFtrends.com Strategist Channel

By Chad Roope

One of the more basic and compelling advantages of cap weighted index investing is tax efficiency. Many portfolio managers today are trying to be too active with portfolio turnover, which may lead to higher tax bills and lower returns. This article will examine the tax ramifications imposed by an active, high portfolio turnover mutual fund relative to a strategic, cap weighted index mutual fund with low portfolio turnover.

While index mutual funds were used for this comparison due to longer track records, exchange traded funds (ETF) often have similar tax advantages. Due to the in-kind creation and redemption process of many ETFs, they possess inherent tax advantages over even index mutual funds. As the analysis will show, while Uncle Sam may be happy when investment managers turn portfolios several times in a given year, long term investors may not be quite as pleased.

Related: Some Things Never Change in Investing…or Do They?

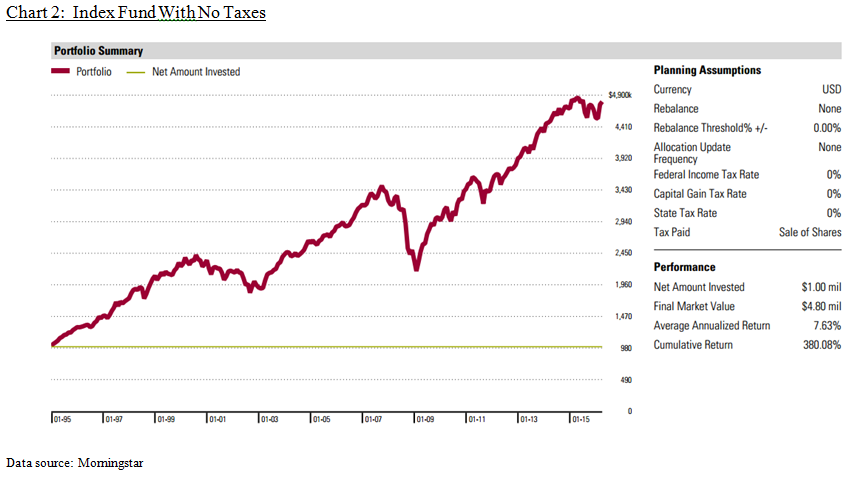

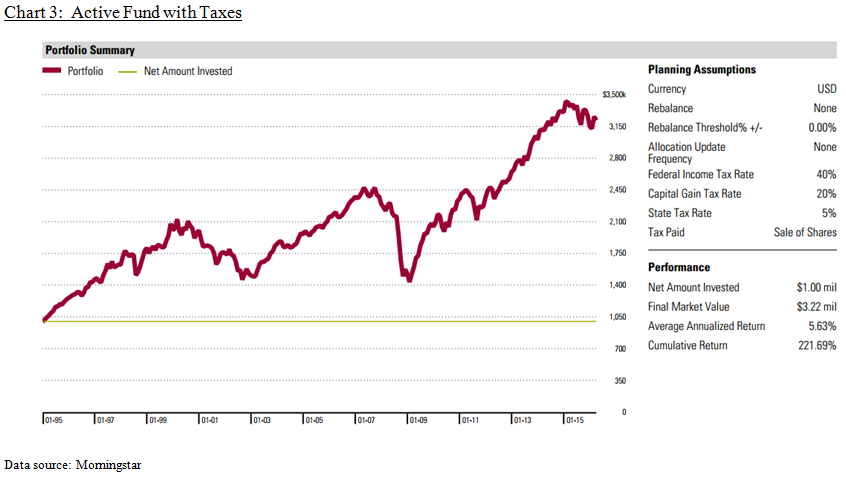

Below are charts of two well-known mutual funds with long term track records. Both funds are classified by Morningstar as “Allocation—50% to 70% Equity”. One fund is an actively managed mutual fund and 3 Star rated by Morningstar. The other fund is a passively managed, cap weighted index fund and 3 Star rated by Morningstar. Both funds will approximate a “Balanced” allocation of 60% equity/40% fixed, however the active fund can vary significantly from these weightings whereas the index fund will maintain nearly exact weightings. The time period illustrated is from 01/01/1995 (earliest common data) to 04/30/2016 assuming no transaction fees or upfront loads or fees.

Performance has been somewhat similar, although the index fund has outperformed over the time period. The active fund has averaged approximately 200% annual portfolio turnover over the last 10 years (2006-2015), whereas the index fund averaged roughly 17% turnover over the same 10 years. Taxes, as shown, are assumed to be the highest marginal Federal bracket. State taxes are assumed to be 5% as state rates can vary significantly. Both scenarios assume $1,000,000 was invested in each fund on 01/01/1995.