Note: This article appears on the ETFtrends.com Strategist Channel

By Gary Stringer, Kim Escue and Chad Keller

We have recently upgraded our outlook on the global economy and financial markets from cautious to cautiously optimistic. That is not to say that the global economy and financial markets are out of the woods. We simply think our two largest risk factors, a U.S. Federal Reserve policy error and a currency shock coming out of China, appear to be contained for now. The Fed relaxed its stance on interest rate increases, which resulted in the U.S. dollar softening and allowed China to spend less of their foreign currency reserves trying to keep up with a stronger dollar. As the exhibit 1 shows, China’s foreign currency reserves have stabilized as the U.S. dollar has fallen. Essentially, the Fed’s softening stance let China off the hook for the moment.

With these risks contained, the global economy should continue to grow, though at a slow pace. For example, the U.S. service sector perked up in April with the ISM non-manufacturing index coming in at 55.7 vs. 54.5 in March (a reading above 50 indicates growth). With a reading of 53.0, the Markit Economics European Union composite purchasing manager’s index suggests steady economic growth across the Atlantic too.

As a result of this economic stability, we recently put more capital to work with the purchase of a global telecom ETF. Global telecom offers defensive equity characteristics based largely on earnings consistency, in addition to an attractive dividend yield.

Related: Market Head-Fake or Greenlight? Neither

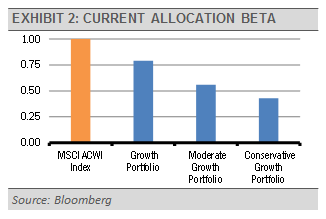

Still, our strategies remain conservatively positioned overall relative to the global financial markets. Using beta as a measure of market risk, exhibit 2 shows that our growth-oriented strategies incorporate significantly less market risk at this time than the global equity market, as represented by the MSCI All Country World Index (ACWI). Within the context of our current outlook, we are looking to protect against negative market movements and are ready to take advantage of better valuations by making additional purchases should equity prices decline.