It has been said that diversification is the only free lunch in investing. The power of diversification is that we can – theoretically – spread our bets out in a way that reduces our risk without necessarily reducing our expected return.

If a picture is worth 1000 words, then the benefits of diversification can be easily summarized by the “asset quilt,” which shows annual asset class returns going back over some historic period.

Below we’ve created such a quilt for popular asset class categories including the S&P 500 (“SPY”), the Barclay’s Aggregate (“AGG”), Foreign Developed (“EFA”), Emerging Markets (“EEM”), REITs (“VNQ”), and commodities (“DBC”).

For many, the takeaway from this quilt is that asset returns are often unpredictable from year-to-year, so a portfolio built upon a foundation of diversification will help smooth out the idiosyncratic risks. The expectation is that each of these asset classes will perform differently in different economic environments, so without perfect foresight, we benefit from spreading out our bets.

For many investors, this is where the use of diversification ends. While you could do much, much worse than a well balanced, strategically diversified portfolio, there are plenty of other ways to build portfolios that are well justified.

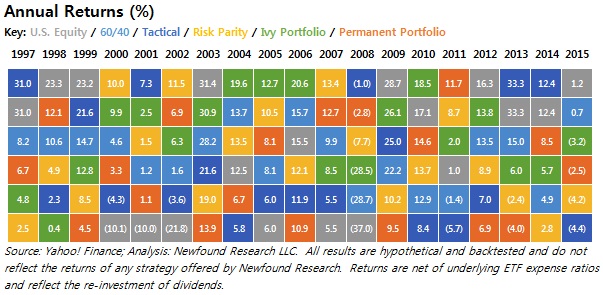

Below I have created a process quilt, showing annual returns for a variety of portfolio construction methods including a passive 60/40 stock/bond portfolio, a trend-following equity strategy, a risk parity strategy, an endowment model, and the permanent portfolio.

Evaluating this quilt leads us to an identical conclusion: we should embrace diversification. Here, however, we are embracing process diversification.

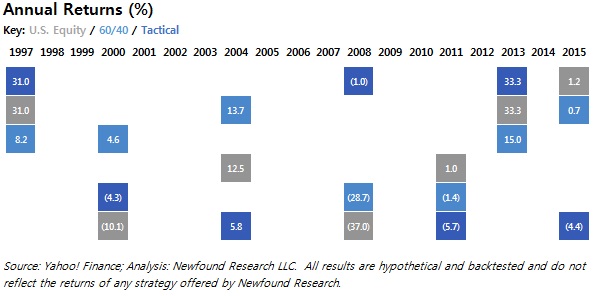

We can highlight the benefits of process diversification by looking at two particular examples: the passive 60/40 and the tactical equity strategy. Just as with different asset classes, our expectations for what environments these processes will perform well in are different.

The passive 60/40 portfolio, for example, will be low cost and avoid potential trading whipsaw; however, equity will be a drag in bear markets (2008) and fixed income will be a drag in bull markets (see 2013). Tactical equity, on the other hand, will likely navigate markets with strong trends much more efficiently, but perform much worse in environments with a high risk of whipsaw (2011 and 2015).