The highest weekly U.S. crude oil stockpiles going back to 1982 and the highest monthly inventories back to 1930 were announced by the U.S. Energy Information Administration (EIA) yesterday. By now, the market is so oversupplied with oil in the near term that more or less supply shouldn’t matter on a daily basis. However, we are seeing the highest volatility since the global financial crisis, as shown in the chart below, but the volatility is still well below the volatility experienced in the demand-driven crises as opposed to this supply-driven oil drop.

Today, in spite of really high inventories that usually diminish supply shock impacts on price, some news came out that caused prices to spike. Reuters reported oil prices reached a new high this year from tension coming out of the middle east. Even though this isn’t the first time in 2015 oil prices rose from political tensions (Feb. supply disruptions in Libya and Iraq increased oil price,) this time is different from the bad news on the demand side.

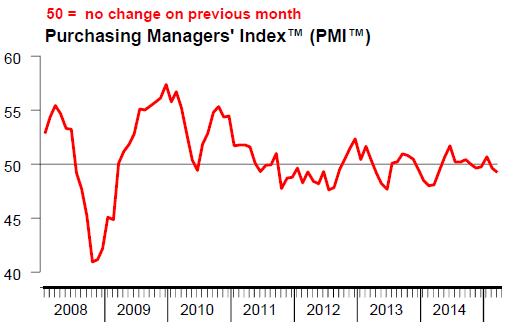

Today, HSBC said its China Manufacturing Purchasing Managers’ Index, a gauge of nationwide manufacturing activity, fell to a one-year low of 49.2 in April, compared with a final reading of 49.6 in March.