This morning, I woke up to the headline Oil just spiked again, on news Saudi Arabia is bombing rebel positions in Yemen. It was the perfect reminder of a call I had earlier in the week from a large pension looking for an oil index to hedge geopolitical risk. After the call, my colleague asked, “Why would an investor use oil to hedge against geopolitical risk?” He continued with more questions like why not use equities or credits from those countries and isn’t it impossible to hedge against geopolitical risk?

In remarks from the Bank of Canada, geopolitical developments often have a major impact on oil prices since they can affect oil supply directly and since the threat of future supply disruptions can also build a risk premium into oil prices. As a notable example, in the early part of 2014, conflicts in Libya and Iraq led to temporary outages in their oil production, keeping world prices high, even as supply elsewhere in the world continued to ramp up. When production from those two countries came back on stream, that was an important trigger for the plunge in oil prices later in the year.

Notice in this chart produced by WTRG Economics the spikes in oil price jumped more than 2 times on average during these critical periods except the first Gulf war.

This behavior is no different today as demonstrated in the chart of oil prices for the past two weeks, hourly. Notice the oil spike from the Yemen bombing, despite the fact it is only the world’s 39th largest producer.

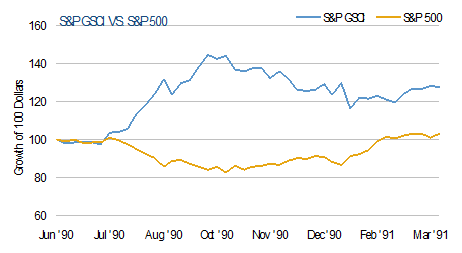

Not only do geopolitical events spike oil (and other commodities) but they may simultaneously hurt the stock market. An article posted by CNN Money just hours ago states, “The surge in oil followed a sharp sell off in the U.S. stock market overnight. European markets were all declining by about 1% to 2% in early trading and most Asian markets closed with losses.” The chart below shows another example of the S&P GSCI rising while the S&P 500 fell during the Persian Gulf War.

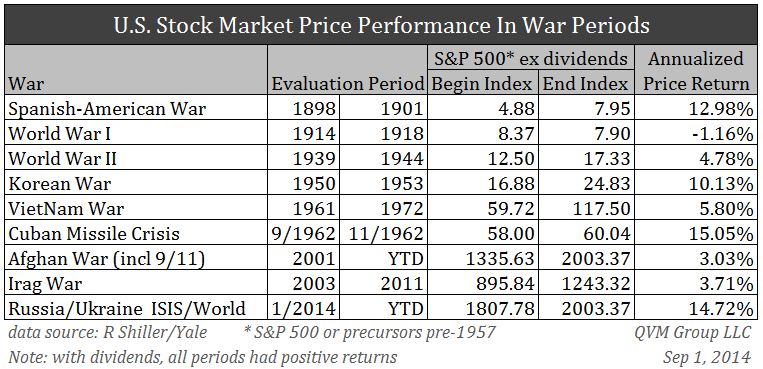

Based on the above, oil has historically performed better than stocks in times of war, though stocks have remained relatively flat in many cases as shown in the table below.

Although not all the countries with high geopolitical risk are necessarily high yield, there should be a link between them given the methodology from OECD to classify the country risk. According to OECD, “the country risk is composed of transfer and convertibility risk (i.e. the risk a government imposes capital or exchange controls that prevent an entity from converting local currency into foreign currency and/or transferring funds to creditors located outside the country) and cases of force majeure (e.g. war, expropriation, revolution, civil disturbance, floods, earthquakes).”